The 2024-2025 ski season is almost upon us. Big-name U.S. resorts like the ones in Vail, Colorado; Park City, Utah; and around Lake Tahoe on the California-Nevada border are slated to open in mid-November, and Colorado’s Wolf Creek Ski Area is already open thanks to an October snowstorm. That means now is a great time to start planning (and budgeting for) a winter getaway.

Even a budget-conscious ski trip can easily cost between $200 and $500 per person, per day when you include lift tickets, gear rentals, meals, lodging and transportation. Tack on some private ski lessons, flights or a splurge on fancy lodging, and that total can quickly multiply.

However, your next trip to the mountain doesn’t have to drain thousands of dollars from your bank account. In fact, you can pay for much of your ski trip using points and miles. Here’s how.

Related: Everything you need to know about packing for a ski trip

Book flights for your ski trip with points and miles

Flights are one of the biggest expenses when taking a ski trip — and one of the easiest ways to save money by using points and miles.

If you have a stash of airline points or miles or a credit card that earns transferable points or miles, you can book award flights directly through airlines. You’ll usually find the best deals either at the very last minute (when hotel prices may not be equally cheap) or far in advance, so we recommend starting your search early. Most airlines offer some sort of calendar feature, allowing you to see which dates have the best prices.

Here are some great options we found.

*Note prices were accurate at the time of publishing.

Flights to mountain airports

There are two strategies for flying to a ski destination. The first is to fly into a small airport that’s close to the slopes. This is very convenient when everything goes smoothly, but keep in mind that you’re less likely to find a nonstop flight to these smaller airports and more likely to see your flight get delayed or canceled due to unpredictable mountain weather. A few years ago, TPG’s Summer Hull was stuck in Aspen, Colorado, for days due to a snowstorm (thankfully, she had built-in trip insurance via her Chase Sapphire Reserve®).

Also, seats on these flights can be quite pricey, especially on weekends or holidays during peak ski season. But there are some fantastic award deals out there that can help you get to your favorite ski slope for (almost) free.

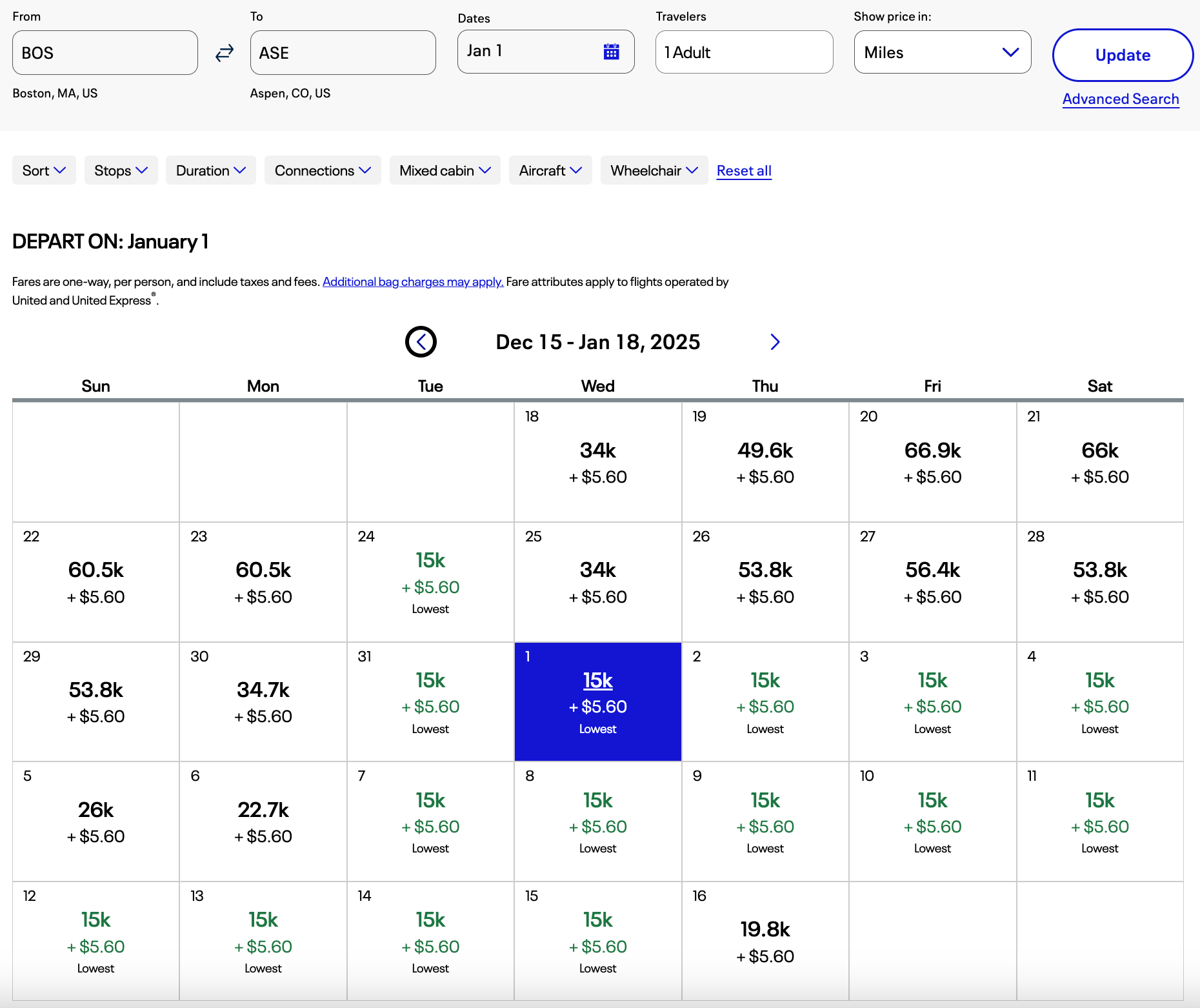

For instance, United Airlines consistently offers Saver awards from many U.S. cities to top ski destinations for 15,000 MileagePlus miles (plus $5.60 in taxes and fees) each way.

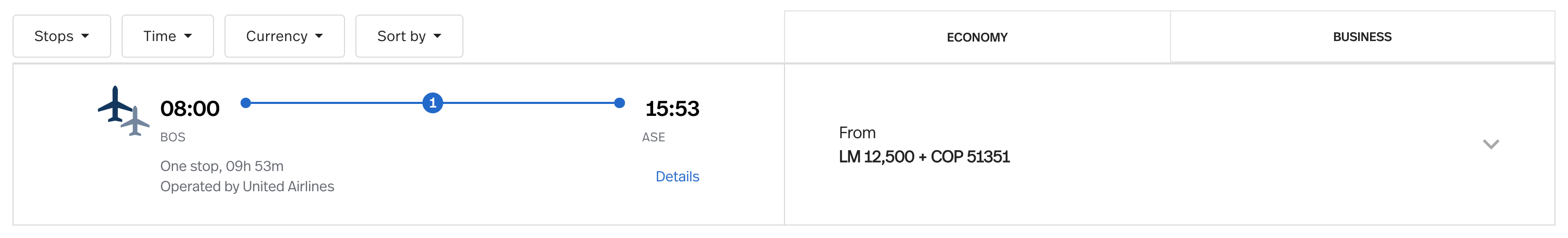

You can often get these flights for less by booking them through Turkish Airlines’ Miles&Smiles program or Avianca LifeMiles instead. In this case, the exact same United flight from Boston Logan International Airport (BOS) to Aspen/Pitkin County Airport (ASE) costs only 12,500 LifeMiles (plus 51,351 Colombian pesos, or about $12) each way.

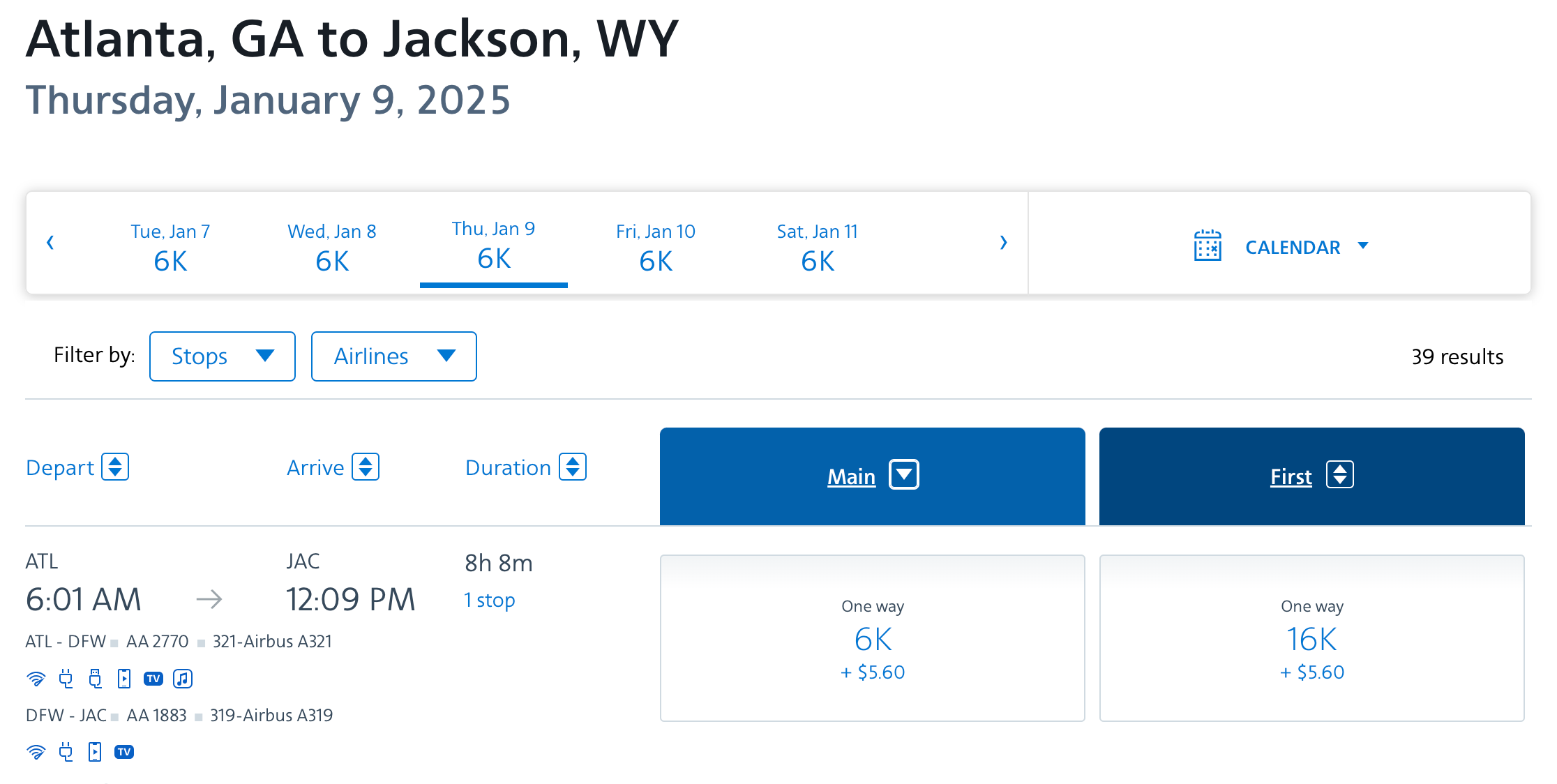

American Airlines has January flights to Jackson Hole Airport (JAC) in Wyoming from East Coast airports like Miami International Airport (MIA) and Charlotte Douglas International Airport (CLT) ranging from 8,500 to 11,000 American Airlines AAdvantage miles and $5.60 in taxes and fees each way. It also has plenty of award space for flights from Hartsfield-Jackson Atlanta International Airport (ATL) and Dulles International Airport (IAD) near Washington, D.C., for only 6,000 miles each way. That’s a great deal for flights that cost roughly $200 to $400 one-way, giving you a value of over 3 cents per mile. (AAdvantage miles are worth 1.6 cents each, per TPG’s November 2024 valuations.)

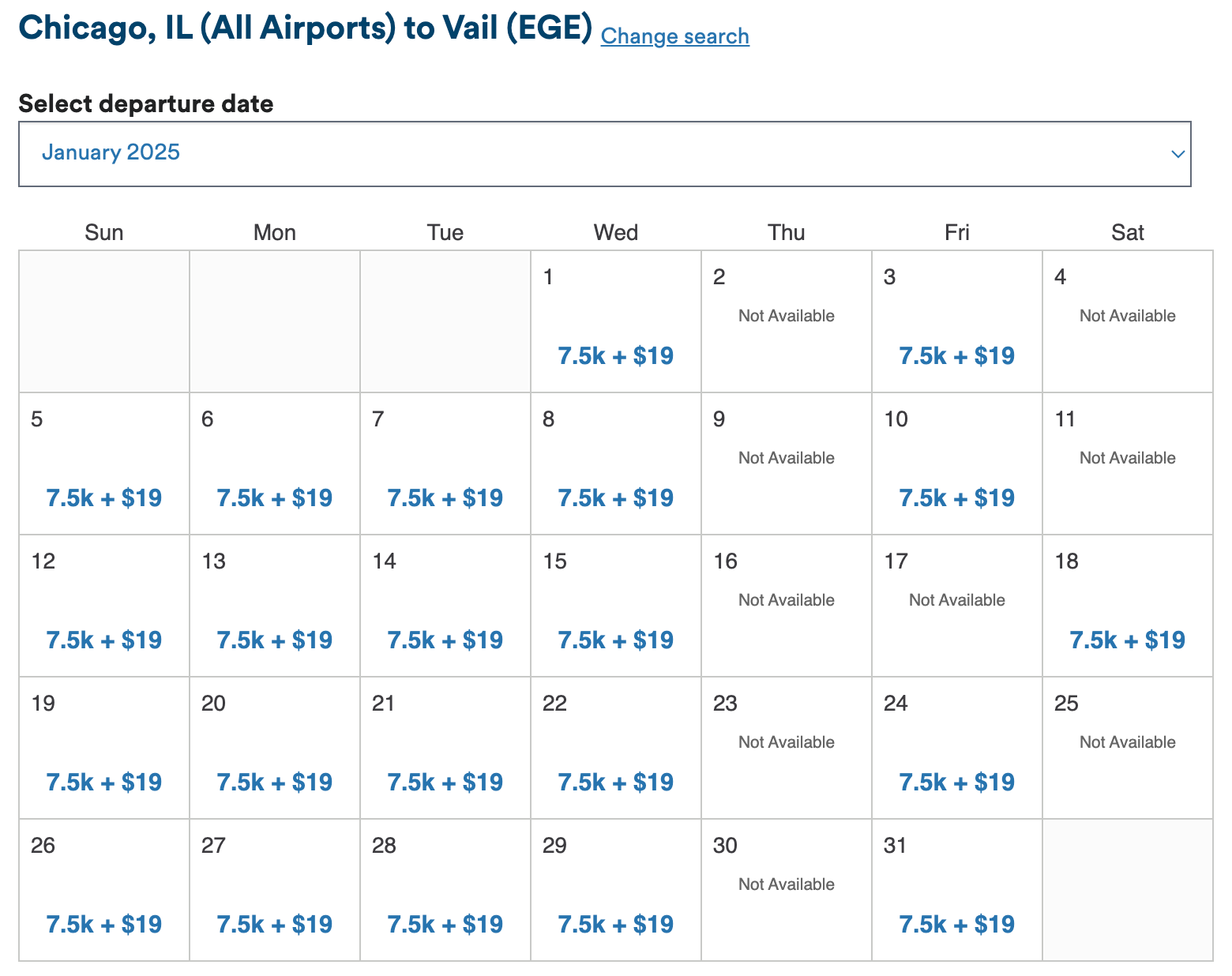

Alaska Airlines Mileage Plan has open award space to Vail’s Eagle County Regional Airport (EGE) from major airports like Chicago’s O’Hare International Airport (ORD), Minneapolis-St. Paul International Airport (MSP) and Seattle-Tacoma International Airport (SEA) for only 7,500 miles and around $20 in taxes and fees each way. Since these flights cost upward of $400 each way, that gives you an excellent value of over 5 cents per mile.

Southwest Airlines doesn’t fly to a ton of smaller ski destinations, but it does serve Yampa Valley Regional Airport (HDN) in Steamboat Springs, Colorado. For example, you could fly from Houston’s William P. Hobby Airport (HOU) to HDN for under 10,000 Southwest Rapid Rewards points each way this January — and if you hold the sought-after Companion Pass, you could bring a loved one for just the cost of taxes and fees. You’ll also get two free checked bags, which is especially helpful when traveling with ski gear.

Most airlines aren’t so generous when it comes to baggage, but having an airline cobranded credit card will often get you at least one free checked bag.

Flights to larger airports

You may choose to fly into a larger airport, even if it’s a little farther from the slopes. Some common ones include Denver International Airport (DEN), Salt Lake City International Airport (SLC) and Reno-Tahoe International Airport (RNO), depending on where you’re planning to ski. This gives you more options when it comes to flights and potentially better award pricing.

For instance, you can fly to Denver on Delta Air Lines this upcoming ski season for under 10,000 SkyMiles each way from places like Seattle (5,500 miles), Minneapolis (6,500 miles), Chicago (7,000 miles) and Boston (9,500 miles). United is currently offering flights to Reno from New York City starting from 13,300 MileagePlus miles each way or from Seattle starting from 10,100 miles one-way. As for American, the carrier has award space to Salt Lake City from Miami, Dallas and Charleston, South Carolina, for around 10,000 AAdvantage miles each way.

Since Southwest doesn’t serve most of the smaller mountain airports, flying into a bigger airport will give Southwest loyalists far more options to use their Rapid Rewards points, Companion Pass or credit card perks.

The downside of this approach is that you will have to arrange travel from the airport to your destination. Thankfully, many ski destinations offer shuttle services and public transportation options, and there are several ways to book rental cars with points or miles — we’ll cover these in more detail later.

Related: Denver airport gets 17 new security lanes — here’s what you need to know

Credit card portals and perks

When researching flights, don’t overlook credit card travel booking platforms, where you can redeem points for flights at a flat rate. For instance, many Capital One cardholders can get 1 cent per mile on Capital One Travel purchases, while those with the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve can get 1.25 or 1.5 cents per point, respectively, using the Chase Travel℠ portal.

In this case, the cost in points or miles correlates to the cash price of a flight. If you find a cheap flight to your ski destination, this could be a great way to book it with points or miles. And because airlines typically code these flights as paid revenue flights, you’ll likely still earn airline points or miles on them.

You can also choose to book a flight in cash and then redeem your points or miles for a statement credit to cover the purchase. For example, the Capital One Venture X Rewards Credit Card offers a rate of 1 cent per mile while allowing you to take advantage of credit card perks like trip cancellation and interruption.

Don’t forget to take advantage of other card benefits, either. Airline cards often provide free checked bags or boarding upgrades. Some cards offer cash back (in the form of a statement credit) on airline incidental purchases; for example, The Platinum Card® from American Express provides an annual (up to) $200 statement credit toward airline incidental fees (enrollment is required). You can use this to cover checked baggage fees (which can really add up on a family ski trip) or pay for seat assignments to ensure your group can sit together.

Simply holding certain cards can get you valuable discounts on award flights. For example, Delta’s TakeOff 15 feature gives many eligible Delta cobranded cardholders a 15% discount on flights booked with Delta SkyMiles, while the United Quest℠ Card provides two 5,000-mile rebates on award flights each year.

Related: United Quest vs. Delta SkyMiles Platinum Amex: Battle of the mid-tier airline cards

Book hotels for your ski trip with points and miles

If you’re a frequent skier, you already know how pricey on-mountain lodging can be during ski season. The good news is that many of these hotels belong to major loyalty programs like Hilton Honors, World of Hyatt and Marriott Bonvoy, meaning you can use your hard-earned points and miles and free night certificates to slash the cost of your ski trip.

Even better, most of these hotels’ sites offer a calendar feature to help you find the best rates and dates for your wintry vacation. Here are some deals we’ve found at the most popular programs.

*Note prices were accurate at the time of publishing.

Hilton Honors

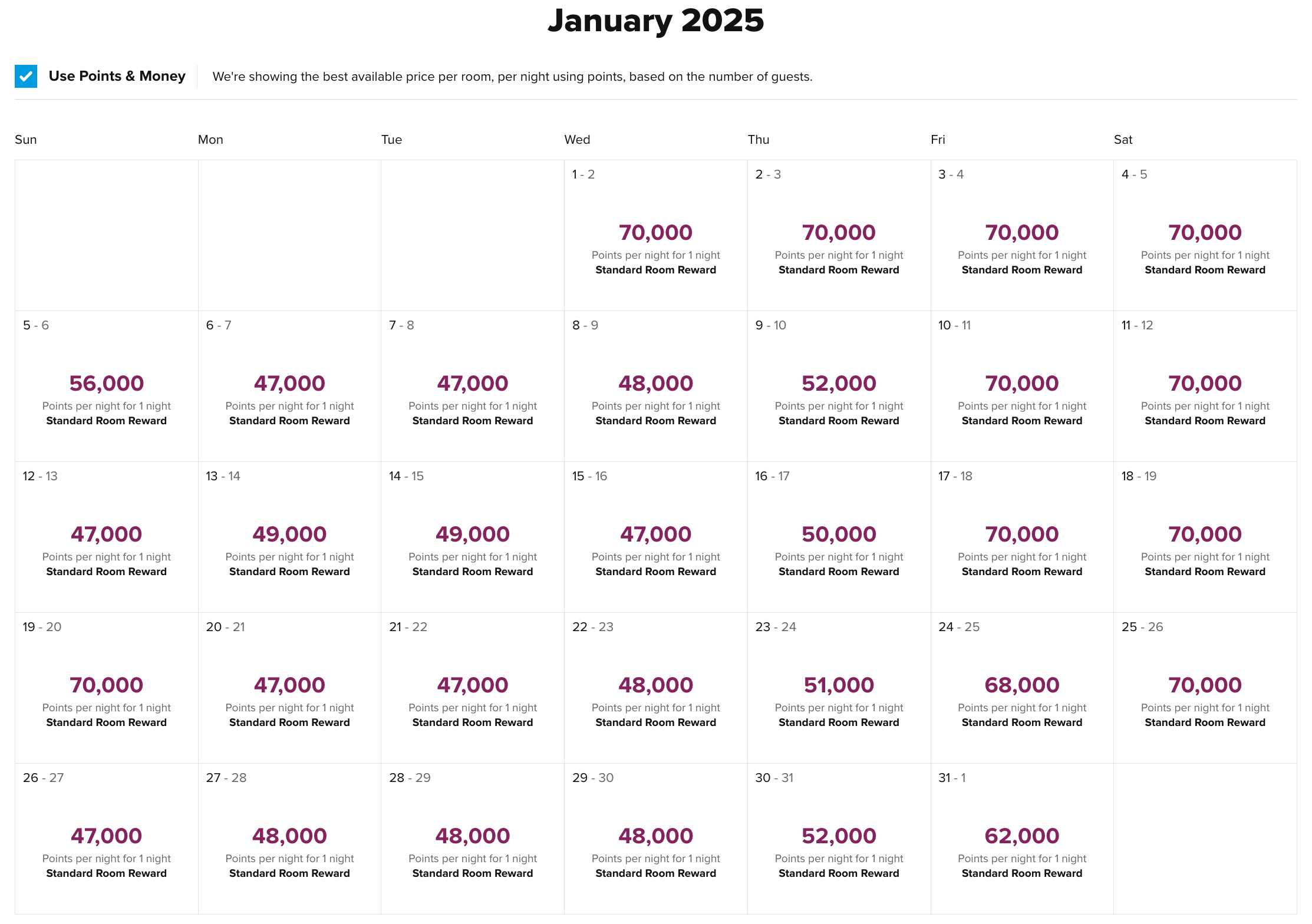

If you’re a Hilton loyalist, there are many options for redeeming your Honors Honors points at hotels at or near ski resorts. With the Hilton Honors program, there’s no set award chart. Instead, the hotel operates using dynamic pricing, except for standard room rewards. Each hotel has a range for the number of points it charges per night for standard room rewards that you can find using Hilton’s Points Explorer tool.

Although you can expect most dates during ski season to fall under peak pricing and thus have the highest award rates, there are some reasonable options out there. For example, the Hampton Inn & Suites South Lake Tahoe runs between 47,000 and 70,000 points per night in January.

Since these are standard room rewards, those with a Hilton Honors American Express Surpass® Card (after spending $15,000 in a calendar year) or a Hilton Honors American Express Aspire Card could theoretically use a free night reward — but we wouldn’t recommend it. These certificates are extremely valuable because you can use them for any standard room reward worth up to 150,000 points. You’re better off using your free night at a property like the Waldorf Astoria Park City, which costs 110,000 points for a standard room reward. Cash rates there during ski season regularly climb to well over $1,000 per night.

The information for the Hilton Honors American Express Aspire Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Like many of Hilton’s ski properties, the Waldorf Astoria Park City is classified as a resort by Hilton, meaning Aspire cardholders can use their semiannual (up to) $200 Hilton resort statement credit there. Other Hilton ski resorts include the DoubleTree by Hilton Hotel Breckenridge, the Hilton Vacation Club Lake Tahoe Resort South, the Homewood Suites by Hilton Mont-Tremblant Resort and the Hilton Whistler Resort & Spa.

Hilton offers several cobranded credit cards to fast-track your Honors points. Many of these provide elite status, which not only gives you perks during your stay but also allows you to book a fifth night free with points.

Related: Best Hilton credit cards

World of Hyatt

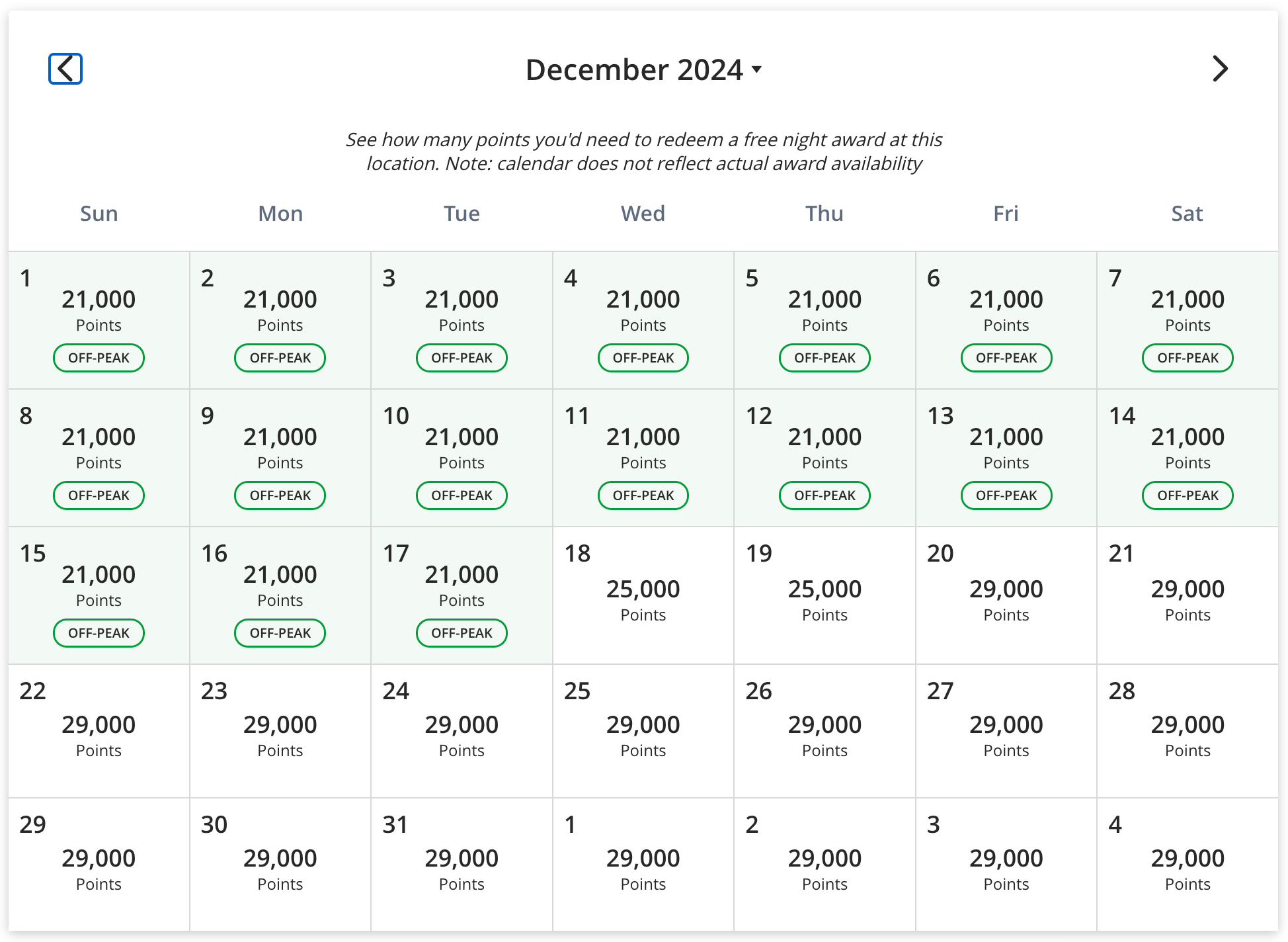

World of Hyatt is a popular hotel program among travelers, in part because it still uses an award chart — which can result in some fantastic Hyatt redemptions.

While the top-notch ski resorts will typically require between 25,000 and 45,000 World of Hyatt points per night, there are a few hidden gems in the program. For example, Hyatt Place Keystone / Dillon and Hyatt Place Park City are both Category 4 properties, meaning they cost only 18,000 points per night on peak dates. For those with the World of Hyatt Credit Card, this is a great opportunity to use your annual Hyatt Category 1-4 free night certificate.

You can often get the most value from your points at higher-category properties. For instance, the Grand Hyatt Deer Valley is a Category 6 property, meaning peak dates will set you back 29,000 points per night. Cash rates average around $1,300 during ski season, giving you a value of roughly 4.5 cents per point — well over TPG’s November 2024 valuation of 1.7 cents each for World of Hyatt points.

When checking award rates at an individual hotel, click “Points Calendar” to see which dates are cheapest. Although most dates during ski season tend to fall under “peak” pricing, you may get lucky.

One major benefit of using your points at Hyatt properties is that resort fees are waived on award stays. Parking fees are also waived for Globalist members, even on paid reservations.

Related: World of Hyatt elite status: What it is and how to earn it

Marriott Bonvoy

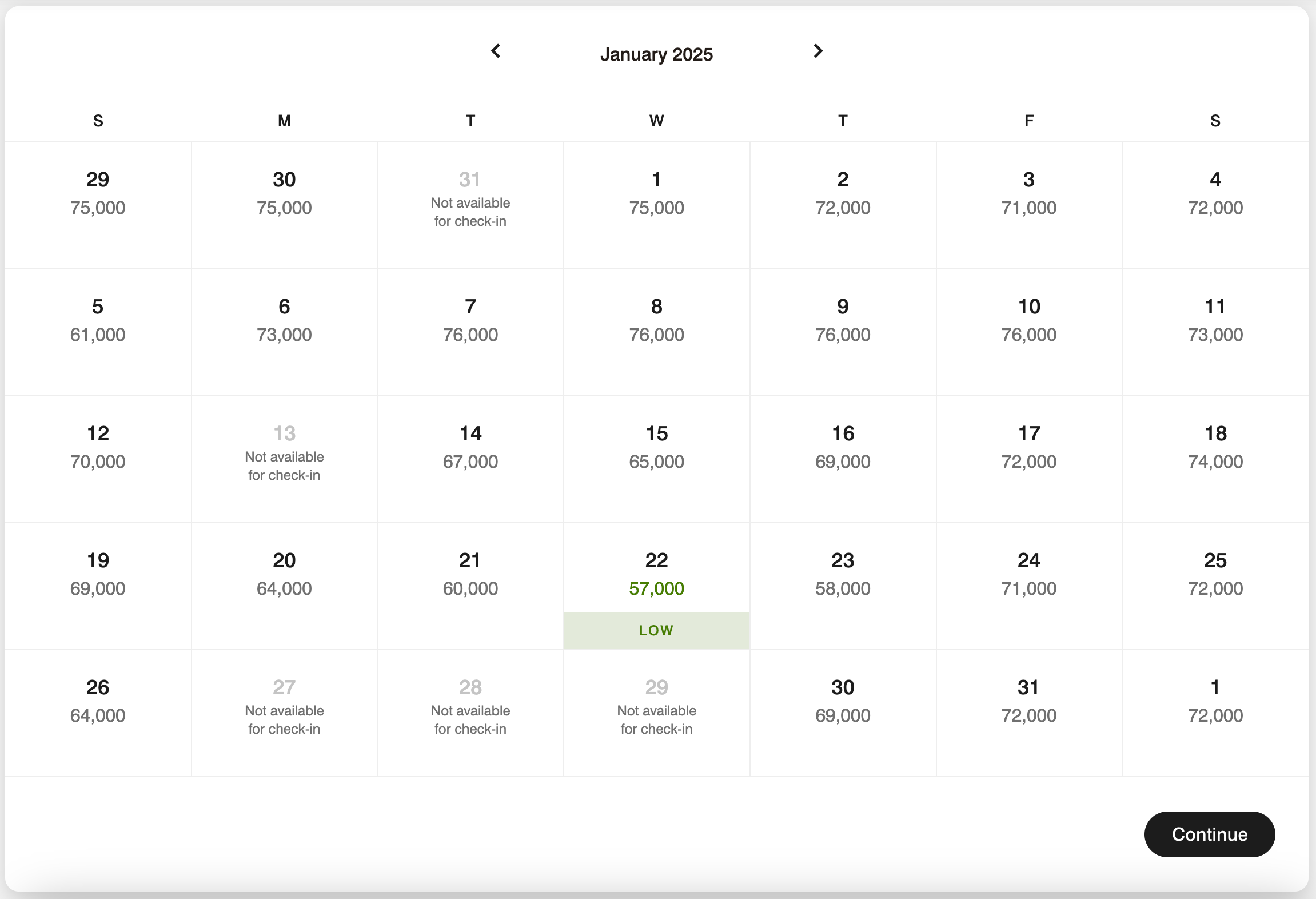

If an annual ski vacation is in your future, you’ll probably want to start earning points within the Marriott Bonvoy program ASAP. That’s because it offers the greatest number of ski-friendly properties across out west and beyond. There’s everything from high-end ski-in, ski-out resorts to more budget-friendly properties not too far from the main ski villages.

Marriott now uses dynamic pricing, and ski season generally translates to the highest rates. You can search for the cheapest dates by checking the “Flexible dates” box when setting the dates for your search.

Some reasonably priced properties include the Residence Inn Steamboat Springs and the Sheraton Steamboat Resort Villas, where award rates this winter are mostly in the 60,000- to 75,000-point range. Both hotels offer full kitchens, so you could save even more by dining in.

But as with Hyatt, you can often maximize the value of your points at Marriott’s luxury properties — if you have enough points to book them. For instance, a weekend at The Ritz-Carlton, Lake Tahoe in January will set you back roughly 125,000 points per night. With cash rates around $1,300, you can get a value of over 1 cent per point. That’s pretty good, considering TPG values Bonvoy points at 0.85 cents apiece, as of November 2024.

Other upscale resorts to consider include The Cloudveil, Autograph Collection in Jackson Hole, Wyoming, and The Sky Residences at W Aspen and The Westin Riverfront Resort & Spa, Avon, Vail Valley in Colorado.

Unfortunately, unlike Hilton and Hyatt, Marriott charges nightly resort fees, even if you book with points or hold elite status. You’ll receive your fifth night free when booking with points, but it’ll take off your least expensive night.

Some Marriott cards provide annual free night awards that you can use at a variety of properties. The Marriott Bonvoy Boundless® Credit Card is currently offering 125,000 bonus points after spending $5,000 in eligible purchases in your first three months from account opening. The Marriott Bonvoy Bold® Credit Card has its best-ever offer: You can earn 60,000 points plus one free night award (valued up to 50,000 points) after you spend $2,000 on eligible purchases within the first three months from account opening. (Certain hotels have resort fees.)

Related: The best Marriott all-inclusive resorts for a perfect vacation

Other hotels and vacation rentals

We’ve covered some of the most popular points hotels, but they aren’t the only ones to consider for your ski trip.

IHG Hotels & Resorts offers a handful of properties conveniently located near ski resorts, like the Holiday Inn Steamboat Springs, the Holiday Inn Express & Suites Park City and the Holiday Inn Club Vacations Tahoe Ridge Resort. Many of these cost 40,000 IHG One Rewards points or less per night, which means you can use your annual anniversary reward night certificate (capped at 40,000 points) that comes with the IHG One Rewards Premier Credit Card. Cardmembers also get a fourth night free on consecutive award stays.

Wyndham Hotels & Resorts has several options that are a little outside of popular ski resorts, resulting in much lower prices. For instance, the Super 8 by Wyndham Dillon/Breckenridge Area is within a half-hour drive of Breckenridge and Keystone, Colorado, and costs only 15,000 Wyndham Rewards points per night. Some Wyndham resorts require a two- or three-night minimum stay, so it can help to check for award availability for multiple nights.

Choice Hotels’ portfolio includes a handful of properties near ski slopes, like Comfort Inn Near Vail Beaver Creek in Colorado and Quality Inn Near Mammoth Mountain Ski Resort in California. The downside is that you can’t book with Choice Privileges points until 100 days in advance.

If you’d prefer a vacation rental — perhaps because you’re traveling with a large group or hoping to save money by dining in — there are a few ways to book vacation rentals with points through places like Vacasa, Marriott Homes & Villas, Homes & Hideaways by World of Hyatt and Bluegreen Vacations. Additionally, some credit card travel portals, like Capital One Travel, now offer a selection of vacation rentals. Another option is to book a Vrbo or an Airbnb with cash and use your credit card points or miles to pay off the purchase.

Related: Planning for ski season: How I booked a $1,500 vacation rental for just 45,000 points

Credit card travel portals

As with flights, you can book hotels directly with points or miles via your credit card’s travel portal. This option is attractive if you hold Chase’s Sapphire Preferred or Sapphire Reserve, as they give you a redemption value of 1.25 cents per point and 1.5 cents per point, respectively, when you book through Chase Travel.

Additionally, the Capital One Venture X Rewards Credit Card provides a $300 travel credit each cardmember year; however, you must book through the Capital One Travel portal.

Get lift tickets and ski gear using points and miles

Once your flight and hotel are taken care of, you might think you’ve covered the bulk of your ski trip expenses. But don’t forget about the cost of lift tickets, ski passes and equipment. These expenses are easy to overlook, but they can quickly stack up to hundreds of dollars per person. Thankfully, there are ways to cover some or all of them with points and miles.

Lift tickets and passes

One tip to save money (or points and miles) and guarantee a day on the mountain is to purchase lift tickets before the season starts. You can do this through advance single-day ticket reservations or a larger package or pass, which generally offer better rates than buying your ticket on the mountain. A season pass makes sense if you plan to take more than one ski trip, and it can even be worth the money for a single weeklong trip. Be aware that pass prices often rise as ski season nears, and sales usually end at some point in fall.

When it comes to using points for lift tickets and passes, you have a few options. Many rewards cards offer a way to put your points or miles toward previous purchases, giving you a statement credit that effectively cancels the purchase. However, the categories you can do this with — and the value you’ll get from your points or miles — depend on what card you have.

For instance, Capital One lets you pay with miles for travel purchases at a rate of 1 cent per mile. However, ski passes typically don’t code as travel purchases; they often code as entertainment. You could redeem your Capital One miles for cash back to cover the cost of your ski pass, but that would give you half the value at 0.5 cents per mile.

One way to get around this is through a site called Undercover Tourist. Several big-name ski passes, such as the Epic Pass, are available for purchase via the site. If you buy your pass through Undercover Tourist, the purchase will code as travel, giving you more options to redeem points and miles.

Let’s say you bought a three-day Epic Pass for $330 on Undercover Tourist with your Capital One Venture Rewards Credit Card. Since Capital One considers this a travel purchase, you could redeem 33,000 miles to cover it. If you bought the same pass elsewhere and it coded as entertainment, you could still redeem your miles for cash back, but you’d need to redeem double the miles to cover the purchase.

Related: What’s the best ski pass this season? Comparing Epic, Ikon, Mountain Collective and Indy passes

Redeem points for ski gift cards

Alternatively, you can put your points toward lift tickets by redeeming them for relevant gift cards. For example, Chase lets you redeem Chase Ultimate Rewards points at a rate of 1 cent each for gift cards at various merchants, including REI. Citi lets you redeem Citi ThankYou Rewards points for gift cards at the same value, and you can sometimes get up to 1.11 cents per point during sales.

You can also redeem 28,600 American Express Membership Rewards points for a $200 Aspen Snowmass gift card, but we don’t recommend it. At less than a 1-cent-per-point redemption, this isn’t a great option for travelers, especially when TPG values these points at 2 cents each as of November 2024. In most cases, you’re better off using your points for flights or accommodations.

Ski for free

In addition to using points and miles, there are many ways for children and seniors to ski for free (or at a drastic discount). Targeting resorts where at least some of the family can ski for less can save you serious cash and/or points and miles.

Rent ski gear using points

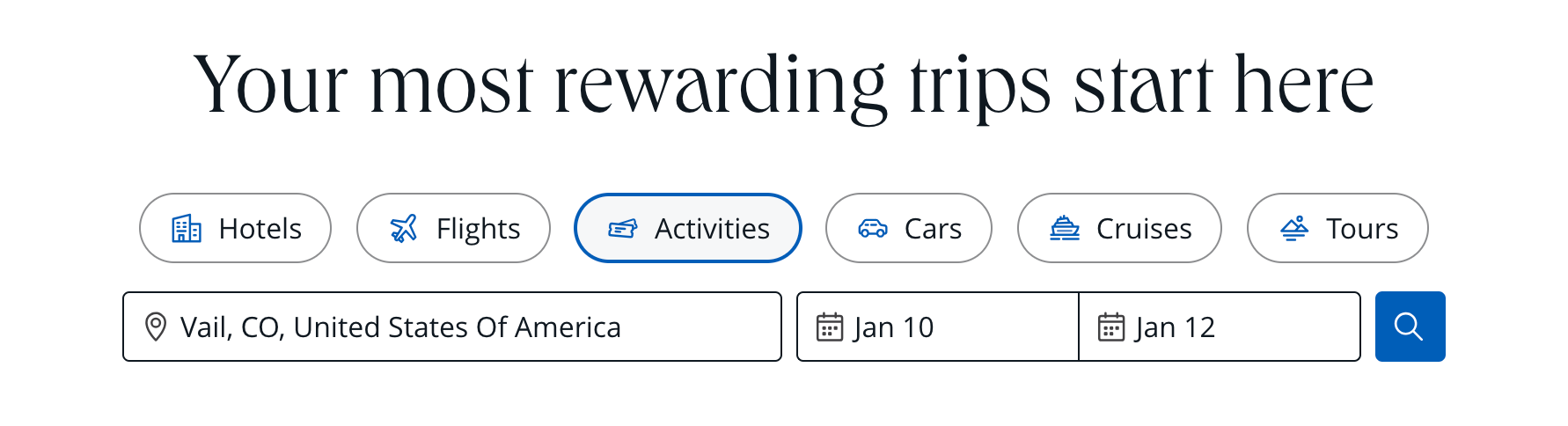

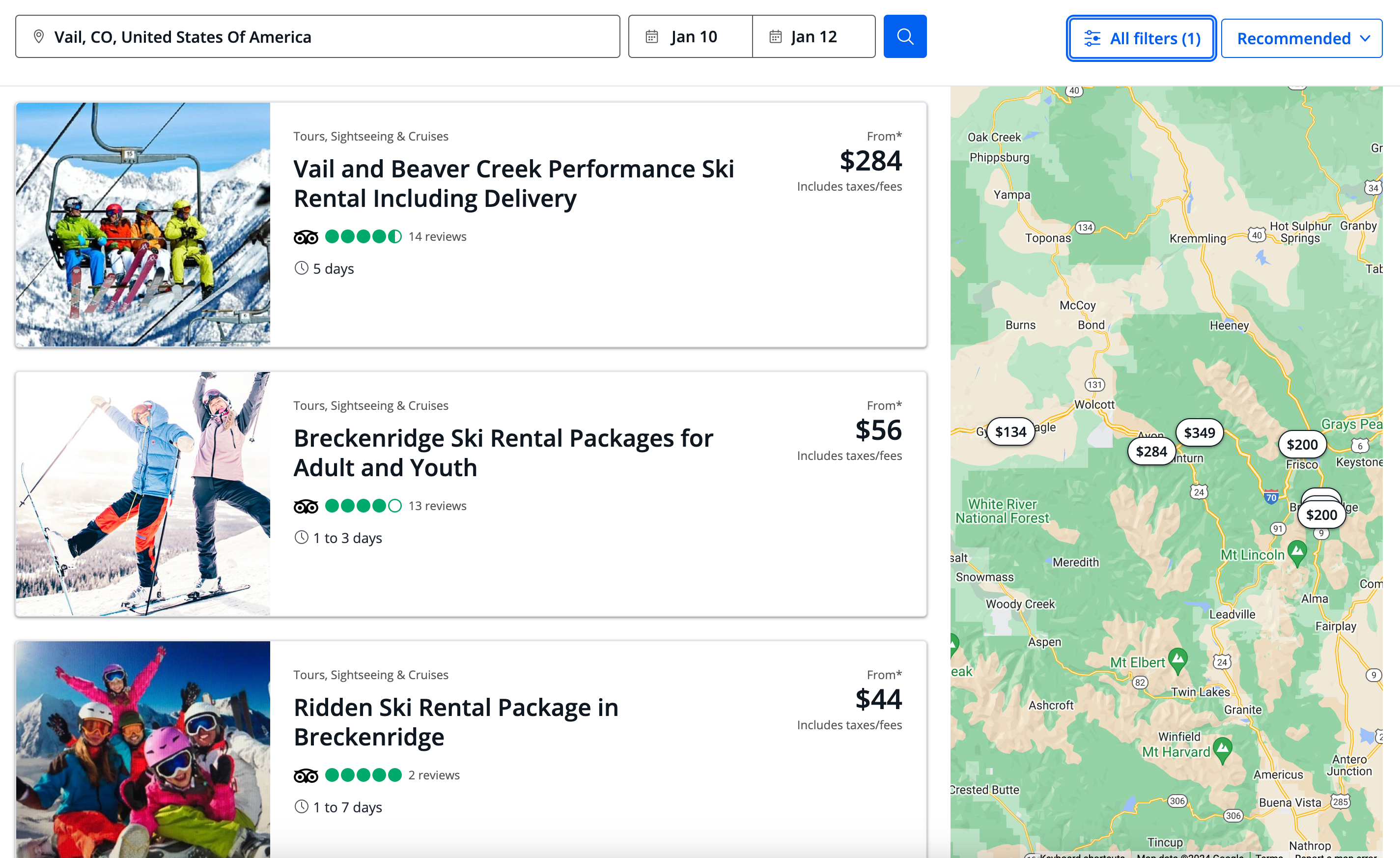

As with lift tickets, you can redeem your points and miles for gift cards or statement credits to put toward ski gear purchases. But if you have Chase Ultimate Rewards points, you can also use them to rent ski gear in many locations.

In the Chase Travel portal, you can redeem points directly for travel. Ski gear rentals are included under the “Activities” tab.

Just enter your destination and dates, then filter the results for words like “ski.”

This is a pretty good use of your points because you’ll get a value of more than 1 cent per point. Sapphire Preferred cardholders can redeem points at a rate of 1.25 cents each; those with the Sapphire Reserve get an even better rate of 1.5 cents each.

Book ground transportation for your ski trip with points and miles

Last but not always least is getting from the airport to the mountain (and back).

Rental cars

If you need a vehicle during your ski vacation, there are several ways to book rental cars with points and miles. As with flights and hotels, you can use rental car rewards points to book your vehicle directly, or you can book it with credit card points or miles through your issuer’s travel portal. You can also use cash-back rewards toward statement credits to cover the cost of a rental car (as well as related purchases like gas and parking).

And don’t forget that many travel rewards cards offer car rental insurance, so you won’t need to pay extra for it. Some cards provide elite status at certain rental agencies, which often comes with perks like vehicle upgrades or a free second driver, saving you even more money.

Related: What I’ve learned from multiple car rentals with the Capital One Travel portal

Shuttles and public transportation

If you’re balking at the thought of paying for a rental car (or navigating snowy mountain roads), a shuttle service or public transportation may be easier on your wallet and your nerves.

Epic Mountain Express offers van service (with free Wi-Fi) from the Denver airport to many Colorado ski areas, such as Vail, Breckenridge, Keystone and Copper Mountain — and Epic Pass holders get a 20% discount. The Snowstang bus runs to several ski hills in Colorado, and Amtrak offers a Winter Park Express train.

Just like with gear rentals, you can sometimes book these shuttles and airport transfers through the Chase Travel portal. And since many ski villages offer free shuttles around town, you probably won’t miss having a car once you get there.

Related: The best credit cards for Amtrak and train travel

Best credit cards for booking ski trips

If you can’t book every part of your ski trip with points and miles, you can at least earn as many points as possible on these purchases by using the right credit card.

For flights, lodging, rental cars, and anything else that codes as travel, use a card that gives you bonus rewards on travel purchases. Many travel cards come with built-in trip protection, eliminating the need to buy travel insurance and giving you a safety net in case your trip doesn’t go smoothly. Here are some of our favorite options:

- Amex Platinum*

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Citi Strata Premier℠ Card (see rates and fees)

For nontravel purchases like lift tickets and ski gear, consider a card that earns bonus rewards on every purchase:

*Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Related: Best credit cards to use on ski trips

Bottom line

Whether you target savings by heading to smaller mountains or leaning into your points and miles, there are plenty of ways to save big on your ski trips this season. But we recommend starting your search now, which will help you find the most options and the best deals.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.