Editor’s note: This is a recurring post, regularly updated with new information and offers.

If you’re taking inventory of the security measures in all areas of your life, don’t leave out your credit.

With a recent alleged hack, potentially every American could have had their Social Security number and physical address stolen. It’s alleged that 2.9 billion records were stolen from National Public Data, a public records company, in April 2024.

Now, it’s more critical than ever to ensure your credit file is secure and you aren’t vulnerable to your personal information getting into the wrong hands. We recommend you check your credit file immediately and see if there are any irregularities to take the necessary precautions. Additionally, you should update passwords to any email accounts, bank accounts or services where your data could be compromised.

While it’s nearly impossible to fully shield yourself from credit card fraud or identity theft, there are some steps you can take, such as freezing your credit. But, of course, credit freezes come with some level of inconvenience, like all security measures.

We’re explaining how and why you may want to freeze your credit.

What is a credit freeze?

A credit freeze prevents you or others from opening an account in your name. It works by preventing creditors from accessing your credit file so creditors and lenders cannot offer you (or anyone pretending to be you) any sort of credit.

A freeze is free, simple to request and has no impact on your credit score.

The catch is that before you can apply for a new credit card or loan, you have to lift your credit freeze first. Fortunately, that’s also free to do, but it is inconvenient if you open new lines of credit regularly.

Related: How to check your credit score for free

How do I freeze my credit?

To freeze your credit, you must request freezes at all three credit bureaus. You can do this online or over the phone.

The bureaus are required to freeze your credit reports within one business day. Once you’ve requested a freeze, each agency will give you a unique PIN or password. It’s vital that you keep the PIN or password in a safe space, as it’ll be needed when you want to unfreeze your report (explained later on.)

Before you go online or call, be ready to provide personal information such as your name, address, date of birth and Social Security number.

Freezing your credit online

You can complete the process online by visiting each credit bureau’s website:

Freezing your credit by phone

You can also contact the companies by phone to request a freeze at the following numbers:

- Equifax: 888-298-0045

- Experian: 888-397-3742

- TransUnion: 888-909-8872

Note that even after you’ve frozen your credit, you will continue to receive prescreened credit card offers unless you opt-out by calling 888-567-8688.

Related: How to protect yourself against rewards program data breaches

Who can access frozen credit reports?

A credit freeze prevents new creditors from accessing your credit report. However, your credit will remain available to some entities, such as existing creditors or debt collectors acting on their behalf. Additionally, government agencies may have access in response to a court or administrative order, a subpoena or a search warrant.

When should I freeze my credit?

You should initiate a credit freeze if you believe your personal information has been compromised. Here are just a few instances that may warrant a credit freeze:

- Your wallet has been stolen and contains personal identification information like a driver’s license, a passport, a Social Security card and credit cards

- You fall victim to a scam

- Your information was compromised during a data breach

- You notice an unfamiliar credit inquiry on your credit report

In any of these cases, you should also file an identity theft report with the government, giving you certain rights to clean up any damaged credit that wasn’t your doing.

Related: How to identify and prevent credit card fraud

Does a credit freeze affect my credit score?

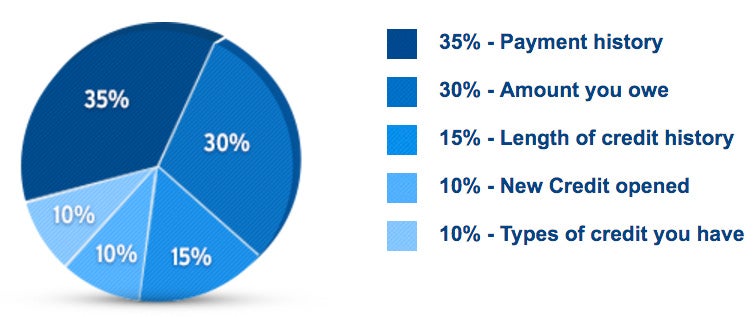

In short, no. Your credit score is used to determine your creditworthiness and is based on your credit history from the three major consumer credit bureaus. A credit freeze doesn’t affect your credit score positively or negatively.

Related: How your credit scores work

Pros and cons of a credit freeze

A credit freeze is the most effective way to prevent fraudulent accounts from being opened in your name — and considering it’s free to do, there’s no reason not to if you think your information has been compromised.

However, a credit freeze also prevents you from being able to open a new account while it is in place. To open a new account, you’ll have to individually contact each agency to unfreeze your credit, which can be tedious. Plus, a credit freeze will not prevent or alert you of fraud on any existing accounts.

Related: What’s the difference between a credit freeze and a fraud alert?

How do I unfreeze my credit?

In a few states, your credit freeze will automatically expire after seven years. In most cases, however, your freeze will remain in place until you ask the credit reporting agency to remove it.

To unfreeze your reports — for example, to apply for a mortgage loan or new credit card — you must contact each of the three agencies individually. Once you request this, the bureaus must lift your freeze within one hour. Here are the links and phone numbers:

- Equifax: 888-298-0045

- Experian: 888-397-3742

- TransUnion: 888-909-8872

You will need your unique PIN or password that was given during the initial credit freeze. When you temporarily unfreeze your report, be sure to give the agencies a specific period or ask to lift it just for a specific party.

Say, for example, you want to open a new credit card. If possible, contact the issuer to ask which agency (or agencies) it pulls your credit information from. Then, ideally, you’ll be able to contact that credit agency (or agencies) and unfreeze your report for either a period or only for the issuer who will be inquiring about your credit file.

Bottom line

Freezing your credit can be a useful tool in helping prevent you from falling victim to identity theft. It can be inconvenient, but many find it worth the peace of mind, especially with the recent alleged data hack.

Further reading:

- So you fell prey to a scam: 5 steps to take when your personal information is compromised

- 8 biggest factors that impact your credit score

- 6 things to do to improve your credit score

- Clearing up confusion: Why your credit score may be different depending on where you look