Editor’s note: This is a recurring post, regularly updated with new information.

Whether you’ve been pregaming for Cyber Monday sales by compiling a wish list of deeply-discounted items (guilty as charged) or are just browsing to see what strikes your fancy, you should be working to maximize those purchases. That includes adding on any extra discounts or rebates you can, earning extra rewards or cash back wherever possible and then paying with the right credit card.

Today, I’ll guide you through the best credit cards to use this Cyber Monday, plus some tips to earn even more while you shop.

In This Post

Best cards for Cyber Monday shopping at major retailers

Where you’re shopping may dictate which credit card you should use. That’s because you could earn bonus rewards based on the type of store you’re shopping at and how it reports to your credit card. For details on that concept, see the following:

- The best rewards credit cards for each bonus category

- The best cash-back credit cards for each bonus category

If you’re shopping at major retailers such as Target, Walmart, Best Buy or Amazon this Cyber Monday, here are the credit cards you should consider using to maximize your earnings on each dollar you spend.

Discover it® Cash Back Credit Card

Annual fee: $0.

Current welcome bonus: None, but there is a Cash Back Match feature at the end of your first year.

Earning structure: Earn 5% back on rotating categories each quarter, allowing you to earn 5% on up to $1,500 spent at the changing list of merchants (you’ll need to enroll to activate your bonus earnings each quarter). During the fourth quarter of 2022, the bonus categories are Amazon.com and digital wallets.

Why we like it: Being able to earn 5% back on Cyber Monday purchases is fantastic. But this gets even better if you’re a new cardholder this year. Discover will match the cash back you earn at the end of your first year — not bad at all for a no-annual-fee credit card.

The information about the Discover it Cash Back card has been collected independently by TPG. The card details on this page have not been provided by or reviewed by the issuer.

For more details, see our full review of the Discover It Cash Back card.

Chase Freedom Flex

Annual fee: $0.

Current welcome bonus: Earn a $200 bonus after spending $500 on purchases within three months from account opening.

Earning structure: Earn 5% back on rotating quarterly categories, 5% back on travel purchased through the Chase travel portal, 3% back on dining at restaurants (including takeout and eligible delivery services), 3% back on drugstore purchases and 1% back on other purchases.

Why we like it: Like the Discover it Cash Back, the Chase Freedom Flex earns 5% back on rotating categories each quarter (on up to $1,500 in spending, then 1% back after that; enrollment is required to activate the bonus earnings). From October to December 2022, those categories include Walmart and PayPal. PayPal is an especially useful bonus category for Cyber Monday because millions of retailers accept PayPal at online checkout — just make sure your PayPal account has your Chase Freedom Flex set as the default payment method.

The real power of this card comes when you hold another credit card that earns Chase Ultimate Rewards points, as you would be able to combine your cash-back earnings with points and double their value according to TPG’s latest valuations.

For more details, see our full review of the Chase Freedom Flex.

Apply here: Chase Freedom Flex

Amazon Prime Visa Signature Card

Annual fee: $0.

Current welcome bonus: Get a $200 Amazon gift card instantly upon account approval.

Earning structure: Earn 5% back on Amazon and Whole Foods purchases. Cardholders also earn 2% back at restaurants and gas stations and get 1% back on all other eligible purchases. Note that these earning rates require an eligible Amazon Prime membership.

Why we like it: It’s hard to beat the Amazon Prime Visa Card when you’re shopping at Amazon. If you’re planning on spending most of your Cyber Monday budget at Amazon, this is a great card to use to maximize those purchases. Through Nov. 28, new cardholders will get a $200 Amazon gift card instantly upon approval.

For more details, see our full review of the Amazon Prime Visa card.

The information about the Amazon Prime Visa Signature card has been collected independently by TPG. The card details on this page have not been provided by or reviewed by the issuer.

Target REDcard

Annual fee: $0

Current welcome bonus: Get $40 off a future qualifying purchase from Target when that purchase is $40 or more. This offer is valid as soon as your account is approved.

Earning rates: Get a 5% discount on all eligible Target purchases.

Why we like it: Unlike other cards on this list, this card offers an immediate discount on your purchases. Getting a 5% discount on Target purchases, both in-store and online, can save you a pretty penny. Plus, cardholders get 5% off at Starbucks locations inside Target.

Other benefits include a 10% discount coupon every account anniversary, 30 extra days for returns and free shipping on most Target online purchases without having to meet the usual $35 minimum. Keep in mind you can only use this card at Target and the card is offered as either a debit or credit card. The debit version can often make more sense as it won’t add to your 5/24 count with Chase.

For more details, see our full review of the Target REDcard.

The information about the Target REDcard has been collected independently by TPG. The card details on this page have not been provided by or reviewed by the issuer.

Apply here: Target REDcard

Best cards for Cyber Monday shopping at smaller retailers

Smaller retailers and online boutiques may not fall into larger bonus categories, so flat-rate rewards credit cards tend to be the best options for these purchases. There is an exception, though, which we’ll highlight below.

The Platinum Card® from American Express

Annual fee: $695 (see rates and fees).

Current welcome bonus: Earn 80,000 bonus points after spending $6,000 on purchases in the first six months of cardmembership. TPG values this bonus at $1,600.

Earning rates: Earn 5 points per dollar on flights booked directly with hotels or through Amex Travel (on up to $500,000 of these purchases per year, then 1 point per dollar), 5 points per dollar on prepaid hotels booked through Amex Travel and 1 point per dollar on other purchases.

Why we like it: This luxury travel rewards card comes with a colossal annual fee to match the eye-popping number of benefits it offers, but this holiday shopping season may be the ideal time to apply for the Amex Platinum. If you’re anticipating thousands of dollars in spending across Cyber Monday and through the end of the year, the welcome offer is substantial. Your holiday shopping could put a large dent into the spending requirements to earn the welcome bonus.

For more details, see our full review of the Amex Platinum Card.

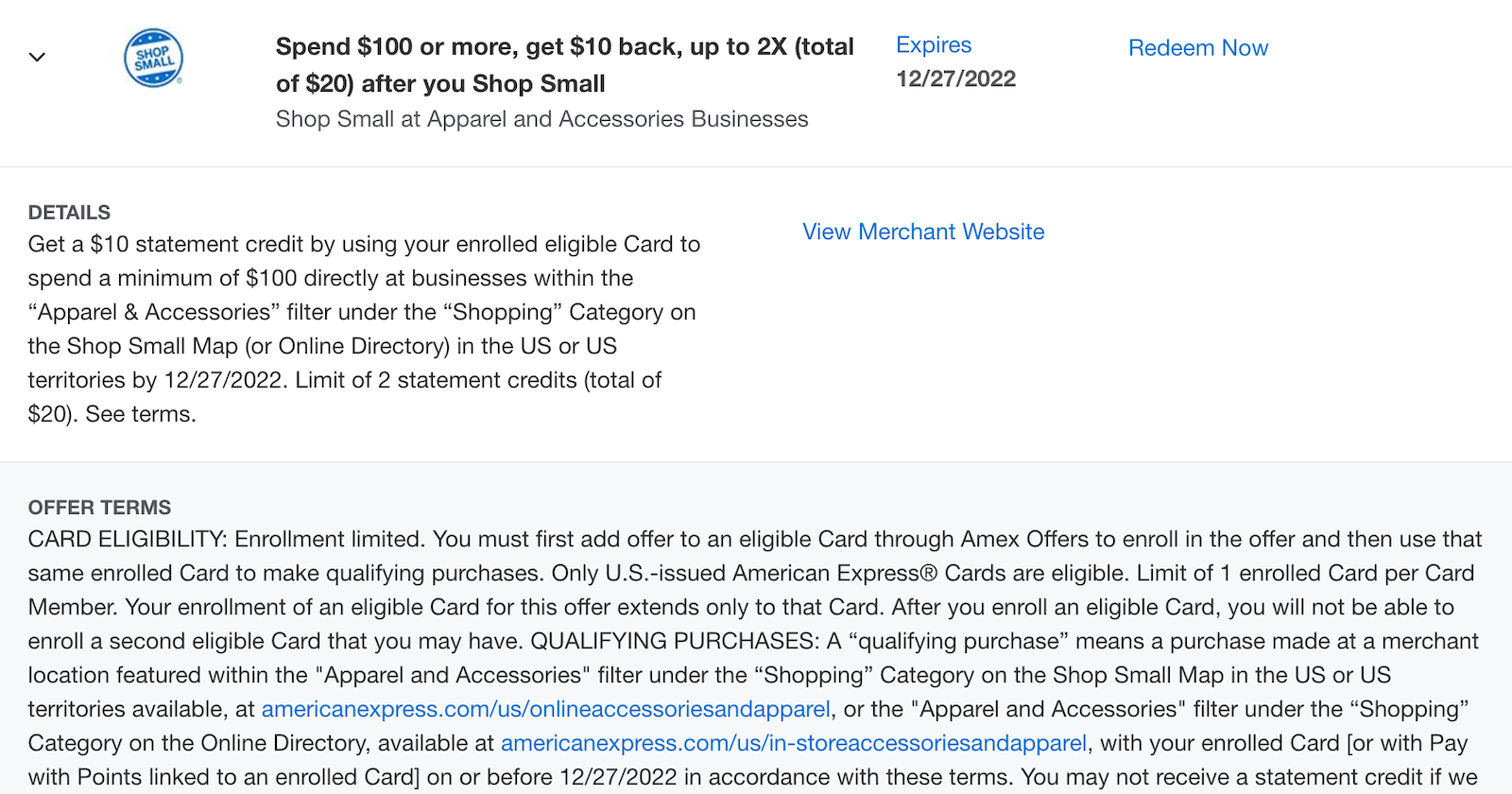

It’s also worth checking your Amex Offers to see if you’re targeted for any rebates or bonus points when shopping at small businesses. This one provides $10 back after spending $100 or more with apparel or accessories businesses as part of American Express’ Shop Small initiative. These are targeted offers, so not everyone will see the same thing; also, you must add the offer to your card before using it.

Apply here: The Platinum Card from American Express

Chase Freedom Unlimited

Annual fee: $0.

Current welcome bonus: Earn an additional 1.5% cash back on up to $20,000 of purchases in the first year.

Earning rates: Earn 5% back on travel purchased through Chase Ultimate Rewards travel, 3% back on drugstore purchases, 3% back on dining (including takeout and eligible delivery services) and 1.5% cash back on all purchases without any earning limits.

Why we like it: Some purchases don’t fall into bonus categories like grocery stores or gas stations. For all of these other purchases, you should use a card that earns well on everyday spending. The Freedom Unlimited will earn 1.5% back on all spending with these “other purchases.” As with the Freedom Flex covered above, the real power of this card comes when you hold another credit card that earns Chase Ultimate Rewards points, as you would be able to combine your cash-back earnings with points and double their value according to TPG’s latest valuations.

For more details, see our full review of the Chase Freedom Unlimited.

Apply here: Chase Freedom Unlimited

Capital One Venture Rewards Credit Card

Annual fee: $95.

Current welcome bonus: Earn 75,000 bonus miles after spending $4,000 on purchases within three months of account opening. TPG values this bonus at $1,387.50.

Earning rates: Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and earn 2 miles per dollar on all other purchases.

Why we like it: You’ll earn 2 points per dollar when shopping in stores or online during Black Friday and Cyber Monday, so this is probably one of your best credit cards for these purchases — no matter which store it is. Capital One miles are worth 1.85 cents each in TPG’s latest valuations, meaning you’ll earn a 3.7% return on spending. You can also look for Capital One Offers to provide additional cashback (more on that below).

For more details, see our full review of the Capital One Venture card.

Apply here: Capital One Venture card

Citi® Double Cash Card

Annual fee: $0.

Current welcome bonus: None.

Earning rates: Earn 2 points on every dollar spent, as follows: Earn 1 ThankYou point for each dollar spent and earn another 1 ThankYou point for each dollar when paying your bill.

Why we like it: Citi ThankYou points are worth 1.8 cents apiece, according to TPG’s valuations. That means you’ll earn a 3.6% return on spending here. If you have the Double Cash and no other Citi credit cards, you can redeem your rewards with three travel partners or redeem for cash back. The real power of this card comes when you have a card like the Citi Premier® Card (which has a $95 annual fee) and can combine your ThankYou points to access all of Citi’s hotel and airline partners for amazing redemption values.

For more details, see our full review of the Citi Double Cash.

You can earn up to 2% back on every purchase with the Citi Double Cash — 1% when you buy and 1% when you pay. Like the others on this list, it’s a great choice to use on purchases that won’t earn rewards with other cards. You are able to convert your rewards into ThankYou points if you also hold an eligible Citi ThankYou credit card. After all, there’s no annual fee on the Citi Double Cash.

Apply here: Citi Double Cash Card

Best cards for Cyber Monday shopping if you’re booking future travel

Numerous airline and hotel brands offer Black Friday and Cyber Monday travel deals every year. If you decide to take advantage of any of these promotions, be sure to use the right travel credit card accordingly.

Capital One Venture X Rewards Credit Card

Annual fee: $395.

Current welcome bonus: Earn 75,000 bonus miles after spending $4,000 on purchases within three months of account opening. TPG values this bonus at $1,387.50.

Earning rates: Earn 10 miles per dollar on hotels and rental cars booked through Capital One Travel, 5 miles per dollar on flights booked through Capital One Travel and 2 miles per dollar on all other purchases.

Why we like it: The earning rate of 2 miles per dollar on everyday purchases mirrors the earning rate of the Venture card discussed above. Where the Venture X card shines is when you’re booking through Capital One Travel. If you find a great deal on a flight or hotel and book through this portal, you’ll earn extra rewards. Even better: Cardholders have $300 in travel credits they can use with Capital One Travel each year, and these can be used to offset the cost of your bookings. This could be a great way to book a free flight for yourself, a friend or a family member.

Cardholders also have access to Capital One Lounges, Plaza Premium lounges and Priority Pass lounges at numerous airports around the world and get 10,000 bonus miles on each account anniversary — plus numerous travel protections in case something goes wrong on your holiday.

For more details, see our full review of the Capital One Venture X.

Apply here: Capital One Venture X Rewards Credit Card

Chase Sapphire Reserve

Annual fee: $550.

Current welcome bonus: Earn 80,000 points after you spend $4,000 on purchases in the first three months from account opening.

Earning rates: Earn 10 points per dollar on hotels and car rentals purchased through Chase Ultimate Rewards travel and 5 points per dollar on flights booked through this portal. You’ll also earn 10 points per dollar on Chase Dining and on Lyft rides (though only through March 2025). Cardholders also earn 3 points per dollar on travel, 3 points per dollar on dining (including takeout and eligible delivery services) and 1 point per dollar on other purchases. Note that the bonus earning rates on travel purchases don’t apply to purchases covered by your travel credit (see below).

Why we like it: What counts as travel on the Sapphire Reserve is defined very broadly, and cardholders have up to $300 in travel credits to use each year. This can be a great way to reduce or eliminate travel spending during Cyber Monday deals. You’ll also enjoy perks with Lyft and access to lounges from Chase Sapphire and Priority Pass once it’s time to take your trip. And if something goes wrong during your trip, you’ll have best-in-class travel protections.

For more details, see our full review of the Chase Sapphire Reserve.

Apply here: Chase Sapphire Reserve

Cobranded airline and hotel cards

Consider using your cobranded cards when you book travel deals directly. Many airline and hotel credit cards offer best-in-class earning rates on brand purchases while offering perks like automatic elite status, free checked bags and more. While I wouldn’t suggest using your cobranded cards on everyday purchases from retailers like Target, you can use your specific cobranded cards when you book deals to maximize Cyber Monday purchases with the associated airline or hotel group.

Related: When does it make sense to spend on a cobranded credit card?

Other tips for maximizing purchases

Thankfully, you can add even more rebates and rewards on top of using the best credit cards for Cyber Monday purchases. If you play your cards right (pun intended), you can triple-dip when shopping online.

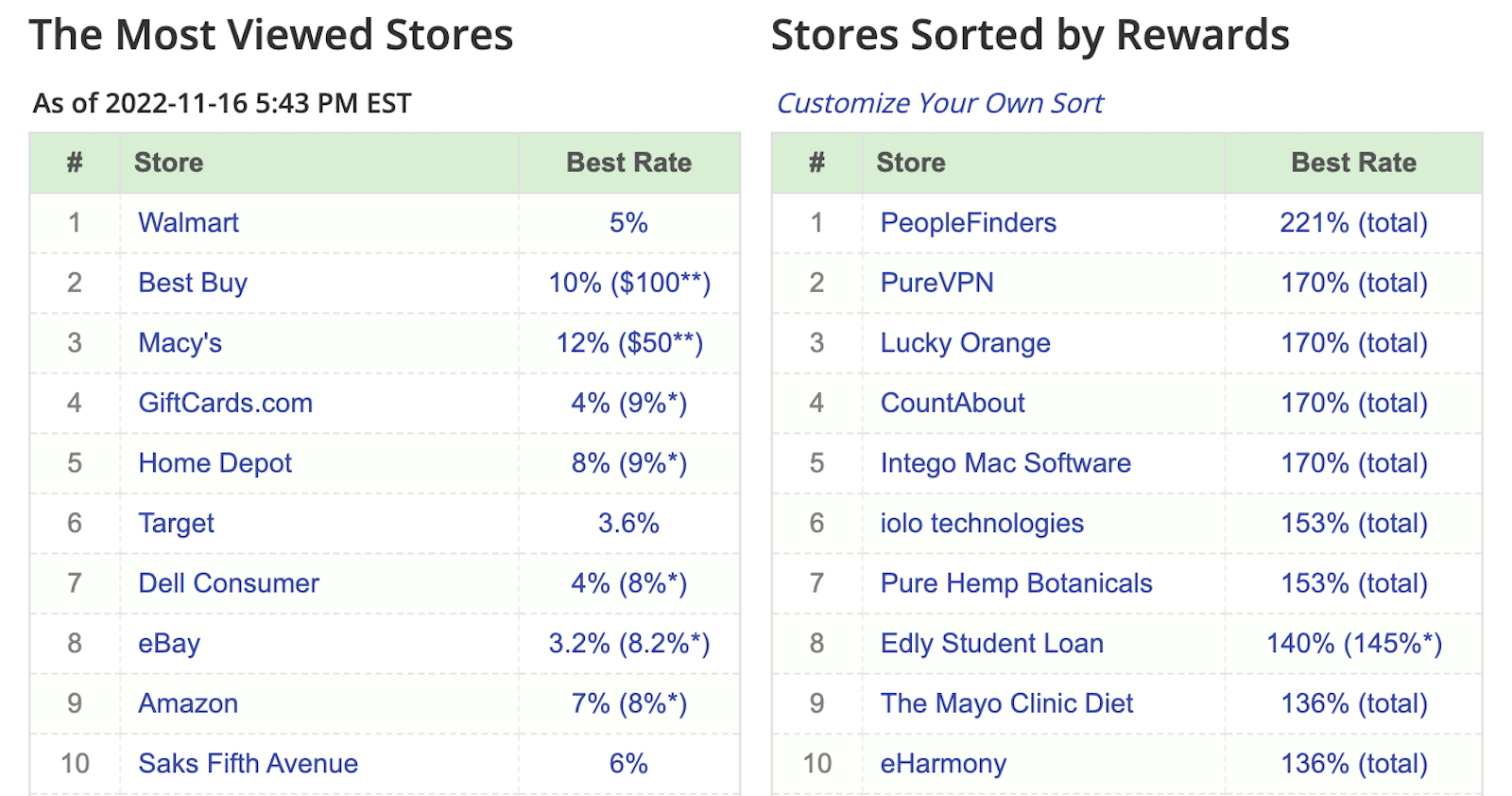

Shopping portals

In addition to maximizing purchases on Cyber Monday by using the best credit cards for the merchants you shop with, make sure you’re also taking advantage of online shopping portals. When you use shopping portals for your Cyber Monday shopping, you can double- or even triple-dip your rewards earnings on top of what you’ll already save with Cyber Monday deals. I personally use the Rakuten Chrome extension and check CashbackMonitor.com to see which portals give me the best return at specific retailers. Plus, most of the major U.S. airlines have their own shopping portals where deals abound.

Related: Your guide to maximizing shopping portals for your online purchases

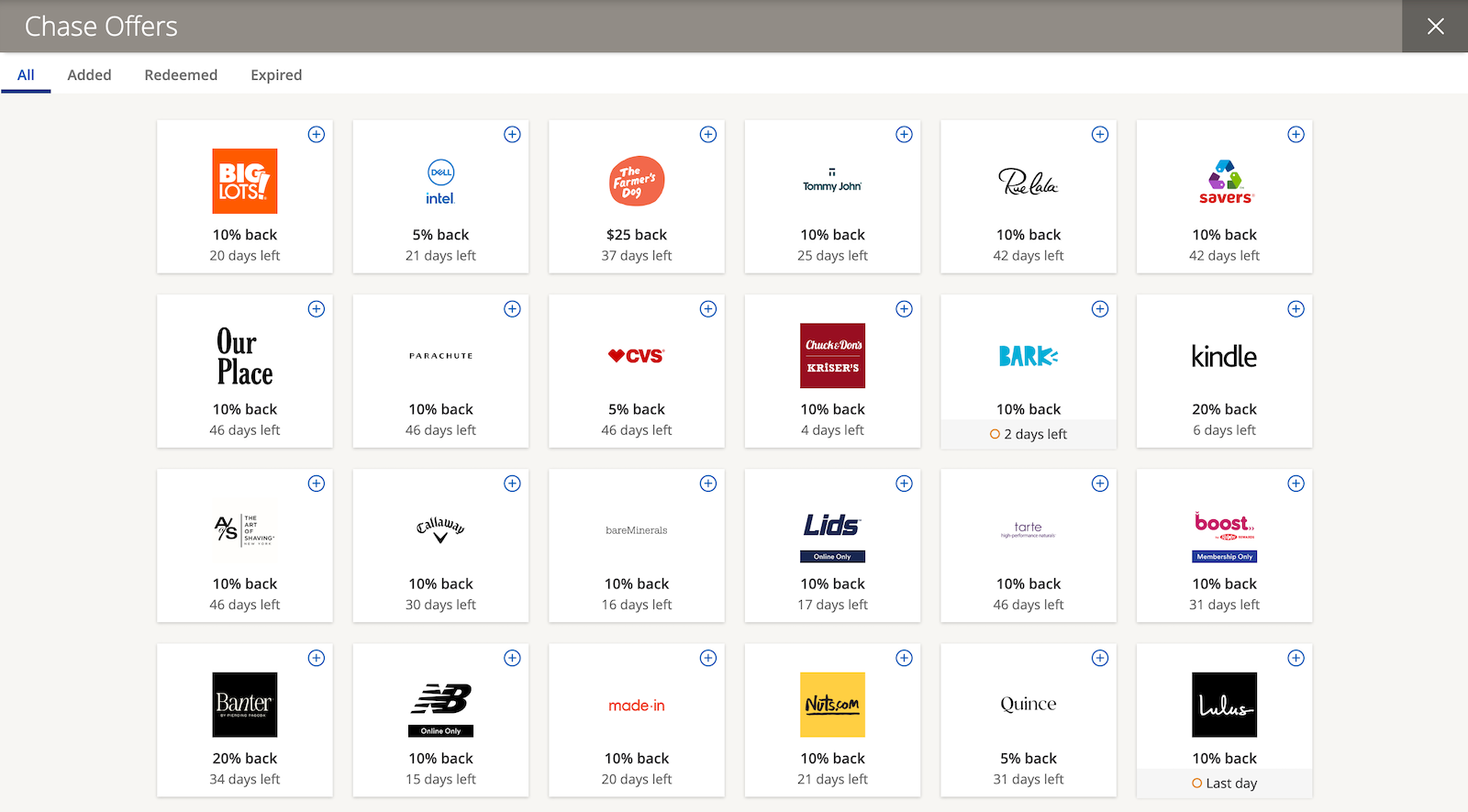

Offers from your credit card issuer

Your credit card issuer may offer a program with rebates that function like coupons or other offers to earn bonus points. These offers are targeted, meaning what you see on one credit card may be totally different from what’s available on another credit card.

However, you should definitely check your Amex Offers, BankAmeriDeals, Capital One Offers, Chase Offers and Citi Merchant Offers.

These offers are targeted and also change regularly, so it’s worth checking your offers regularly. A few extra clicks to use a portal or add an offer to your credit card before making a purchase can lead to big savings or a big pile of extra rewards.

Related: Save money on your holiday purchases with these offers

Bottom line

To get the best deal possible this Cyber Monday, use the right credit card.

With potentially hundreds (or thousands) of dollars in spending over the next month, you’ll want to make sure you earn those bonus points, miles and cash back that will help boost your balances as you head into 2023.

It could also be a great time to sign up for a new credit card and put your holiday shopping on that card so you can earn a great welcome bonus. See here for the best credit card bonus offers currently available.

Official application link: Chase Freedom Flex.

Official application link: Amex Platinum Card.

Official application link: Chase Freedom Unlimited.

Official application link: Capital One Venture.

Official application link: Citi Double Cash.

Official application link: Capital One Venture X.

Official application link: Chase Sapphire Reserve.

For rates and fees of the Amex Platinum Card, click here.

Additional reporting by Stella Shon and Ryan Smith.