Want to save even more money when you’re booking flights and hotels with your Capital One Venture X Rewards Credit Card? Well, here’s an easy strategy to help you save.

TPG values Capital One miles at 1.85 cents each when you transfer them to airline and hotel partners such as British Airways, Turkish Airlines and Wyndham. But there’s another way of looking at it that could make your Capital One miles even more valuable.

The Capital One Venture X Rewards Credit Card offers 10 miles per dollar for hotels booked through Capital One Travel and 5 miles per dollar spent on flights booked through the portal. Other cards, such as the Capital One Venture Rewards Credit Card and the Capital One Spark Miles for Business, earn 5 miles per dollar spent on hotels and rental cars and 2 miles per dollar on all other purchases, including flights.

So, where do extra savings come in?

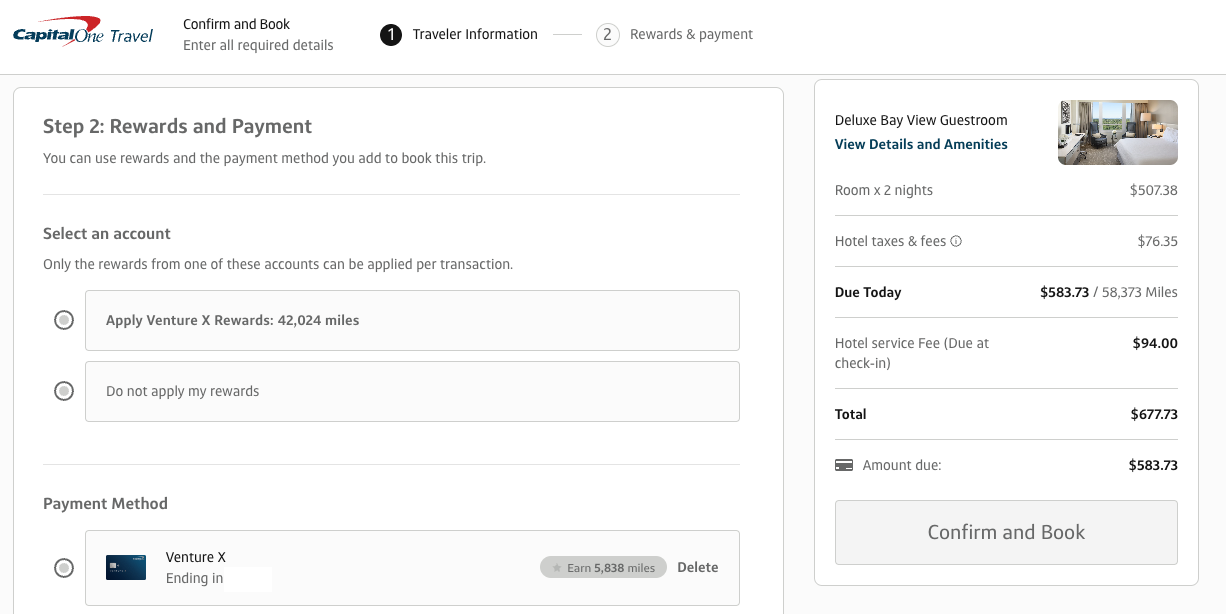

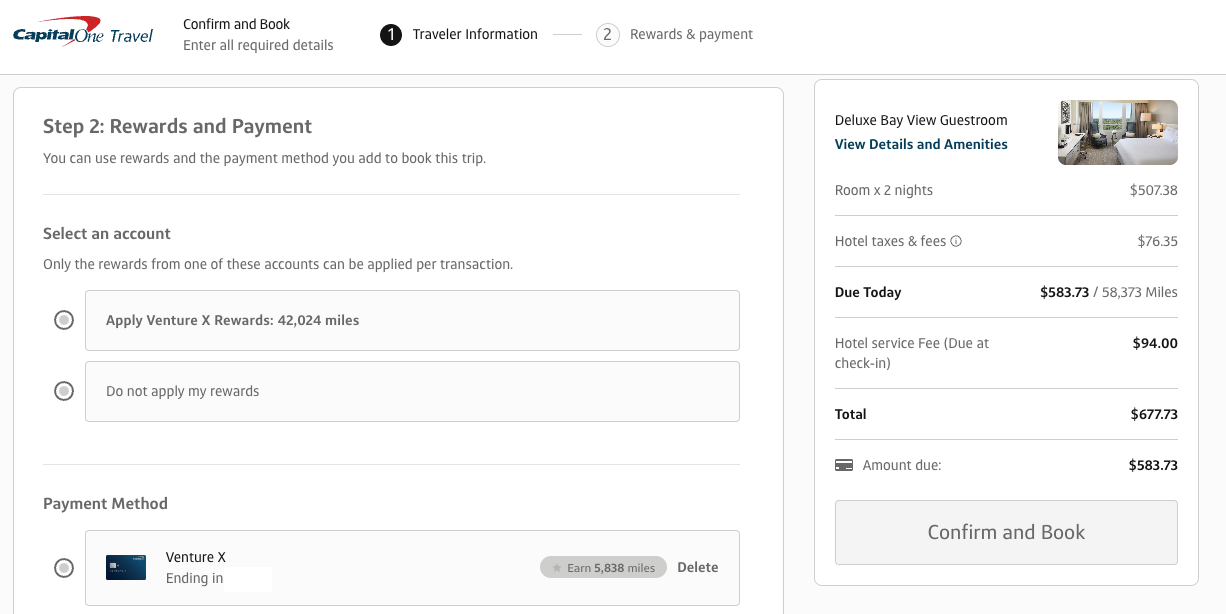

When browsing Capital One Travel, you’ll notice that you can pay with either cash or miles. Below is an example of a weekend stay in Miami. At checkout (not including the hotel service fee due at check-in), you’ll pay either $583.73 or 58,373 miles (a value of 1 cent per mile) for this stay.

If you were to pay strictly with miles, your card would never be charged — and therefore, you would not earn any rewards. But if you were to pay with the Venture X Rewards card, you would earn 10 miles per dollar on this purchase. That translates to 5,838 miles.

Capital One lets you cover travel purchases from your statement within 90 days of the purchase date at a rate of 1 cent per mile. Redeeming your rewards this way is the superior option because it allows you to earn miles for your spending.

Therefore, once this travel purchase posts to my account, I can still use 58,373 Capital One miles to remove it from my statement as though my card was never charged, but because I initially purchased my travel with cash instead of miles, I’m 5,838 miles richer. That’s effectively a 10% rebate on my hotel booking.

If I were to book a flight through Capital One Travel using the same method, I would earn 5 points per dollar, so I could earn a 5% rebate by paying with the card and then using my points to “erase” the statement.

The downside to doing this? You likely will not earn hotel points or be able to use elite status benefits on bookings made through Capital One Travel. This is because the major hotel chains usually require you to book directly to receive these benefits. However, flights booked through Capital One Travel typically earn miles as usual and are eligible for all elite status benefits, so make sure you add your frequent flyer number before you fly.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Bottom line

Don’t use Capital One miles when booking hotels, rental cars or even flights through Capital One Travel.

It’s almost always a better idea to make your travel purchase with your Capital One card to earn miles on your spending — that way, you can redeem your miles to offset the expense within 90 days of the purchase date.

This booking method will ensure you earn miles for the purchase, even if you know you want to redeem miles to cover the charge.