Editor’s note: This is a recurring post, regularly updated with new information.

When all you have is a debit card, checking how much you’re spending and how much money you have left is mostly straightforward. Your bank account balance almost immediately reflects your transactions all in one place. But when you add credit cards into the mix — as you should, so long as you’re able to use them responsibly — things get a little more complicated.

Your bank account balance might read $1,000, but if your credit cards have balances ranging from $100 to $600, it’s easy to fool yourself into thinking you have more money than you actually do. Throw in balances in apps such as Venmo, Apple Pay or even savings apps including Robinhood and Acorns, and things get even more convoluted.

But fear not — there are several ways to help keep track of your assets and liabilities, or your net worth. Mint by Intuit was among the most popular financial management apps, but with it phasing out as of Jan. 1, 2024, you might be in the market for a new one. Here are a few to help keep your spending in order.

Simplifi by Quicken

The Simplifi by Quicken app gives users a consolidated snapshot of their finances, right at their fingertips. The app can connect to more than 14,000 financial institutions, allowing users access to their bank accounts, credit cards, loans and investments all in one place.

It also automatically categorizes your transactions so you know where your money is going. The app makes it easy to find and track recurring bills and subscriptions that can be canceled when you no longer use them. You can also view upcoming bills, income and transfers to see how they affect your balances.

Cost: Starts at $2.39/month.

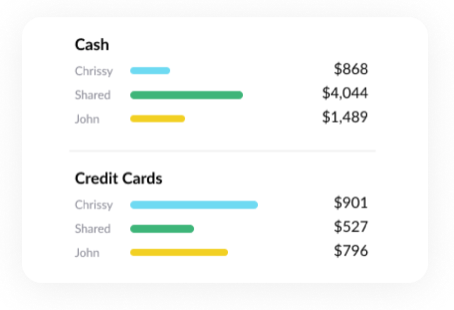

Zeta Money Manager

Couples who want a better picture of their joint and separate finances should consider downloading the Zeta Money Manager app. It supports more than 10,000 U.S. institutions to track your individual and joint accounts to give you the fullest picture of your finances. The app shows where your money is going, allows you to message your partner on specific transactions, split purchases and even manage your bills together. You can create shared goals, bill-paying reminders, individual and joint budgets and even custom categories for your expenses.

Cost: Personal account $4.99/month or joint account $9.99/month.

PocketGuard

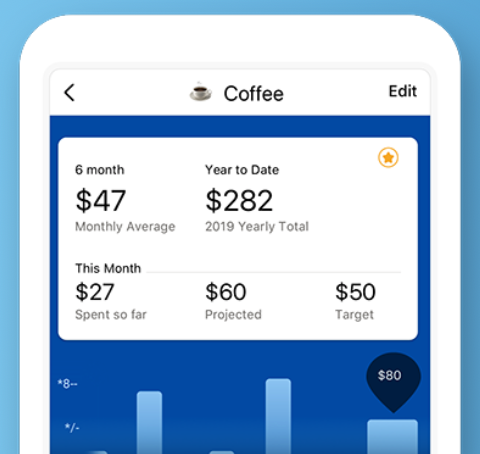

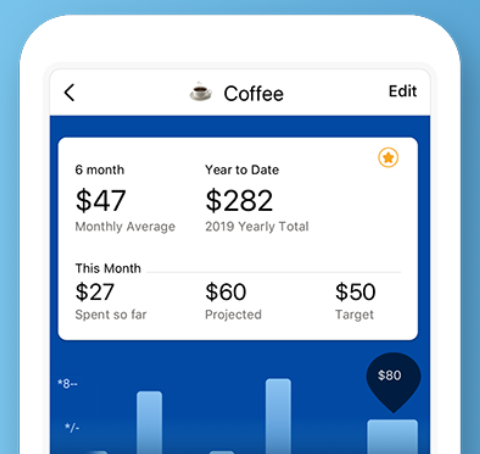

PocketGuard is very similar to Mint, offering both an app and a desktop service to help you keep on top of your spending, net worth, budget and goals. While PocketGuard isn’t as well laid out as Mint, you still can categorize your transactions any way you’d like, and the app will help you stay within your budget by sending notifications and providing visuals to show you how much you’re spending — overall and within each category.

On the downside, PocketGuard doesn’t show your credit score and lacks some basic functionality. While it’s still a good option for finding your net worth and keeping track of your spending, there’s nothing that PocketGuard offers that you can’t get using Mint.

Cost: Free (a PocketGuard Plus version with additional features like pocket cash tracking is available for $7.99 a month or $34.99 a year).

Related: 4 Ways to check your credit score for free

Albert

Unlike PocketGuard, Albert is an app with no desktop version available. Albert acts somewhat as a personal financial assistant, sending you texts and notifications about your spending habits, budget and bills.

Like with PocketGuard, you can sort your transactions into customizable categories to help you better budget and track spending. You can easily find your net worth, and the app creates an “Albert Score” to show you how well you’re meeting your budgeting goals.

Albert places a particular emphasis on saving, encouraging you to put aside money in a rainy day fund by automatically depositing set amounts of cash into a savings account on a regular basis.

Cost: Free (Genius membership, which gets you access to personalized advice from a team of financial experts, is available for $14.99/month).

YNAB (you Need A budget)

YNAB, one of the most popular personal finance apps, follows the principle that every dollar needs a job. Through their app (available in both the Apple App Store and Google Play), desktop site and Amazon Echo add-on, you can manage your budget.

The four rules YNAB enforces are:

- Give every dollar a job

- Embrace your true expenses

- Roll with the punches

- Age your money

Users can link their personal accounts so their available balances can be put into the software’s debt manager. All of their income and account balances are split up into user-created categories to dedicate funds toward expenses such as groceries or transportation.

YNAB also includes an API to its services to allow users to access more personalized budgeting features.

The service also offers a collection of videos, articles and daily live workshops to help those interested in budgeting to be successful. YNAB claims that new users can save $600 in the first two months and $6,000 in the first year.

Cost: 34-day free trial, then $14.99/month or $99/year.

Related: What budgeting technique is right for you?

Personal Capital

Personal Capital is best known for its investment features. However, this app is also great for budgeting as well. The app allows users to access advice from automated and human financial advisors.

The app also tracks all of your income and expenses, which are then separated into categories so you can see where you’re spending money. Some features included in Personal Capital are a retirement planner, asset classes and an analysis of your investment fees.

You can see your net worth, bills that you need to pay and your current portfolio through the dashboard.

Cost: Free

DIY Spreadsheet

If using an app seems like too much of a bother, or if you’d rather track your expenses by yourself, it’s easy to create a spreadsheet in Excel or Google Sheets that keeps track of your net worth.

Creating a spreadsheet is relatively simple. All you have to do is make columns for all of your assets and liabilities, and then create a simple algorithm that calculates the difference. You’ll have to update the information yourself and it doesn’t have a built-in budgeting feature, but it’s a simple way of making sure you know your net worth.

There are basic budgeting templates available for free, and if you’re a savvy Excel or Sheets user, there are some functions that can help you automate your budgeting. If you have a very specific layout for budgeting in mind, it might be worth it to go DIY and create your own budgeting dashboard using a spreedsheet.

Cost: Free

Related reading: The emotional psychology around money with behavioral finance expert Michael Liersch

Bottom line

There are several options out there for helping you manage your money, whether you’re a college kid balancing school and work, or a professional with a yearly salary. While some of these apps have paid add-ons, most can be used without spending a dime.

Having a credit card can often be daunting, as keeping track of your expenses is no longer as easy as just checking your bank account app. Don’t get bogged down or intimidated, and don’t succumb to accidentally spending more than you can pay back. Using any one of these apps to organize and track your spending will undoubtedly help you stay on top of the game.

Related: