Chase Ultimate Rewards points give you access to some of the best hotel and airline transfer partners in the business, as well as Chase Travel℠, the issuer’s easy-to-use travel portal that allows you to redeem points for a wide variety of bookings, including rental cars, hotels, flights, tours and activities.

Despite increasing competition from American Express Membership Rewards, Citi ThankYou Rewards, Capital One miles and Wells Fargo Go Far Rewards, Chase Ultimate Rewards has maintained its place as one of the most valuable and useful points currencies.

If you’re ready to get serious about traveling more for less, here’s everything you need to know about how to earn and redeem your Chase Ultimate Rewards points.

What are Chase Ultimate Rewards points?

Ultimate Rewards points are the currency of most Chase-branded credit cards. You can earn Chase Ultimate Rewards points for everyday spending on these cards that you can then redeem for a wide range of rewards.

If you’re just getting started in the world of travel credit cards, it’s typically best to start with Chase products, thanks to the issuer’s well-documented 5/24 rule. In short, you generally can’t get approved for any Chase cards — including those that earn Ultimate Rewards points — if you’ve applied for five or more new credit cards across all banks in the past 24 months.

Keep this restriction in mind as you build a strategy to maximize your credit card rewards.

Related: The ultimate guide to credit card application restrictions

How do I earn Chase Ultimate Rewards points?

There are many ways to earn Chase points at rates of 1 to 10 points per dollar spent, depending on the specific Chase credit card you carry.

The first three cards below earn fully transferable Ultimate Rewards points all by themselves, while the remaining four are technically billed as cash-back credit cards.

However, if you have a full Ultimate Rewards points-earning card, you can combine your Chase cash-back rewards in a single account, effectively converting your cash-back rewards into fully transferable points. For this reason, having more than one Chase card can make sense to maximize your earning and redeeming potential.

Here are the seven cards that allow you to earn Chase Ultimate Rewards points.

Chase Sapphire Preferred® Card

Welcome bonus: You’ll receive 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That’s worth over $900 when redeemed through Chase Travel.

Why you want it: This is a fantastic all-around travel credit card. It earns points at the following rates:

- 5 points per dollar spent on Lyft (through March 2025)

- 5 points per dollar spent on all travel purchased through Chase Travel

- 3 points per dollar spent on dining, including eligible delivery services, takeout and dining out

- 3 points per dollar spent on select streaming services

- 3 points per dollar spent on online grocery purchases (excluding Target, Walmart and wholesale clubs)

- 2 points per dollar spent on all other travel

- 1 point per dollar spent on all other purchases

The Sapphire Preferred has no foreign transaction fees and comes with many travel perks, including delayed baggage insurance, trip interruption/cancellation insurance and primary car rental insurance.

Annual fee: $95

Application link: Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

Welcome bonus: You’ll receive 75,000 points after you spend $4,000 on purchases in the first three months from account opening. That’s worth $1,125 when redeemed through Chase Travel.

Why you want it: Put simply, you want this card for its earning power and its travel perks that can easily cover the annual fee. It accrues the following earnings:

- 10 points per dollar spent on Lyft (through March 2025)

- 10 points per dollar spent on Chase Dining booked through Ultimate Rewards

- 10 points per dollar spent on hotel and car rental purchases through Chase Travel

- 5 points per dollar spent on airline travel booked through Chase Travel

- 3 points per dollar spent on travel not booked through Chase

- 3 points per dollar spent on other dining purchases

- 1 point per dollar spent on all other eligible purchases

Other perks include an easy-to-use annual travel credit worth $300, a fee credit for Global Entry or TSA PreCheck (up to $100 once every four years) and Priority Pass Select lounge access, as well as entry to the growing list of new Sapphire lounges. This is one of the few cards that allows you to use your Priority Pass membership for discounted meals in airport restaurants, though this benefit will no longer be available from July on. Cardholders also get primary car rental coverage, trip interruption/cancellation insurance and other protections.

Annual fee: $550

Application link: Chase Sapphire Reserve®

Ink Business Preferred® Credit Card

Welcome bonus: You’ll receive 100,000 points after you spend $8,000 on purchases in the first three months from account opening.

Why you want it: This is one of the best credit cards for small-business owners, earning 3 points per dollar on the first $150,000 spent in combined purchases on travel, shipping, internet, cable and phone services, and advertising made with social media sites and search engines each account anniversary year. You earn 1 point per dollar spent on all other purchases, and points don’t expire as long as your account is open.

Annual fee: $95

Application link: Ink Business Preferred® Credit Card

Ink Business Cash® Credit Card

Welcome bonus: Earn up to $750: $350 bonus cash back after you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months from account opening.

Why you want it: Earn 5% cash back on the first $25,000 in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year (then 1%). Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year (then 1%). You can convert these earnings to Ultimate Rewards points if you have one of the three cards above.

Annual fee: $0

Application link: Ink Business Cash® Credit Card

Ink Business Unlimited® Credit Card

Welcome bonus: Earn up to $750 cash back (which can become 75,000 Ultimate Rewards points) after you spend $3,000 on purchases in the first three months your account is open. Plus, an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

Benefits: Earn unlimited 1.5% cash-back rewards on every purchase. These cash-back earnings can be converted to Ultimate Rewards points if you have one of the top three cards listed above, meaning your small business can essentially earn 1.5 points per dollar spent on all charges made with this card.

Annual fee: $0

Application link: Ink Business Unlimited® Credit Card

Chase Freedom Flex℠

Welcome bonus: Earn $200 after you spend $500 in the first three months of account opening

Benefits: The card earns 5% back on select bonus categories, which rotate every quarter and apply up to $1,500 in combined spending (activation required). Past bonus categories include gas stations, supermarkets, restaurants, warehouse stores and department stores. You can convert these rewards to valuable Ultimate Rewards points if you have one of the top three cards listed above. Plus, earn 5% on travel purchased through Chase Travel, 3% on dining at restaurants (including takeout and eligible delivery services) and 3% on drugstore purchases.

Annual fee: $0

Application link: Chase Freedom Flex℠

Chase Freedom Unlimited®

Welcome bonus: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year), worth up to $300 cash back.

Benefits: These earnings can be converted to valuable Ultimate Rewards points if you have one of the top three cards listed above. Plus, earn 5% on travel purchased through Chase Travel, 3% cash back on dining at restaurants (including takeout and eligible delivery services) and 3% on drugstore purchases. Earn 1.5% on all other purchases. The card also offers 120-day purchase protection and extended warranty protection.

Annual fee: $0

Application link: Chase Freedom Unlimited®

Other Chase credit cards

Note that there are many other Chase-issued credit cards that aren’t listed here, including:

- Those that are no longer available to new applicants, like the Ink Plus and Chase Freedom

- Those that don’t fully participate in the Ultimate Rewards program, like the Ink Business Premier® Credit Card, which exclusively offers cash back and doesn’t allow rewards to be combined with other cards

- Cobranded products with a partner’s loyalty program, like United Airlines cards and Southwest Airlines cards, which don’t participate in Ultimate Rewards

Do Chase Ultimate Rewards points expire?

Chase Ultimate Rewards points do not expire, provided you keep at least one card that earns Ultimate Rewards points open.

If you cancel all your Ultimate Rewards cards, you must redeem or transfer your points before closing the last card. Otherwise, you will forfeit the points.

What are Chase Ultimate Rewards points worth?

TPG values Ultimate Rewards points at 2.05 cents apiece. This is largely due to the array of valuable transfer partners like World of Hyatt and United Airlines MileagePlus, as these options give you valuable flexibility in your redemptions.

However, you’ll get varying values for Chase points if you pursue other redemption opportunities. For example, Ultimate Rewards points are worth 1.5 cents apiece through Chase Travel for Sapphire Reserve cardholders and 1.25 cents for those with the Sapphire Preferred or Ink Business Preferred. You’ll also have access to Chase Pay Yourself Back as a cardholder of any of the above cards, and there are occasionally offers to use Chase points for Apple products or gift cards at an enhanced value.

Finally, Chase points are worth 1 cent apiece if used for simple cash back.

What are the Chase Ultimate Rewards transfer partners?

You can transfer Ultimate Rewards points to 11 airline programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

Chase also partners with three hotel programs:

All transfer ratios are 1:1 (though there are occasional transfer bonuses), and you must transfer points in 1,000-point increments.

Options to redeem Ultimate Rewards points

When redeeming Ultimate Rewards points, you have three basic options:

- Fixed-value, non-travel redemptions (e.g., cash back, gift cards, Apple products)

- Fixed-value Chase Travel bookings

- Transfers to travel partners

The “best” option comes down to your travel needs. Points are here to save you money, and you should use them when it suits you.

That being said, you should aim for the highest value whenever possible. Here’s a look at all of your options.

Transfer to travel partners

Transferring Ultimate Rewards points to travel partners often can be the most valuable way to redeem your hard-earned points. With 14 transfer partners, you have plenty of options, and you can keep your Chase points in your Ultimate Rewards account until you are ready to transfer them, which provides excellent flexibility. Our favorite sweet spots include:

- Top-tier Hyatt hotels: The World of Hyatt award chart is incredibly inexpensive compared to some competitors. You can book some of the fanciest Park Hyatt properties in the entire portfolio, including the Park Hyatt New York and the Park Hyatt Sydney, for 35,000 points per night during off-peak dates. TPG values Hyatt points at 1.7 cents each, so 35,000 points are worth $595. That’s a great deal for hotels that routinely sell for close to $1,000, even when demand is low. There’s also great value at the lower end of the Hyatt award chart. Category 1 hotels range from 3,500 to 6,500 points per night, depending on peak, standard and off-peak pricing.

- Iberia flights to Madrid: Round-trip flights from New York’s John F. Kennedy International Airport (JFK), Chicago’s O’Hare International Airport (ORD) and Boston Logan International Airport (BOS) to Spain’s capital will only set you back 34,000 Avios in economy, 51,000 points in premium economy or 68,000 points in business class when you transfer your Chase points to Iberia Plus. Considering that most airlines charge at least 60,000 miles for a one-way business-class award to Europe, you’re essentially getting a 50% discount.

- Flights to Hawaii with Alaska Airlines and American Airlines: By transferring your Ultimate Rewards points to British Airways, you can book awards with Oneworld partners American Airlines and Alaska Airlines. As long as your nonstop flight distance is under 3,000 miles each way, you can leverage British Airways’ (unpublished) distance-based award chart to fly from any West Coast gateway to Hawaii for only 26,000 Avios round-trip.

- All Nippon Airways flights booked through Virgin Atlantic: For just 145,000 points, you can fly round-trip in first class between the West Coast and Tokyo. Flights from other U.S. gateways only cost an extra 25,000 points (170,000 points round-trip). Business-class redemptions are an even better deal, costing just 90,000 to 95,000 points round-trip, depending on your U.S. departure airport. If possible, you’ll want to route through JFK and fly ANA’s “The Room” business class, which is only available on select routes.

- Short-haul flights to Canada: Aeroplan stuck to an award chart for partner redemptions but added dynamic pricing for Air Canada flights. As a result, you can often find super-cheap short-haul tickets from the U.S. to Canada. For example, a flight from JFK to Toronto Pearson Airport (YYZ) can be booked for under 6,000 points one-way on many dates.

Book via Chase Travel

You can book through Chase Travel and redeem points for your plane tickets, hotel stays, rental cars or experiences at a fixed cash value per point.

As a Chase Sapphire Preferred or Chase Ink Business Preferred cardholder, each point is worth 1.25 cents. If you have the Chase Sapphire Reserve, your points are worth 1.5 cents each toward travel redemptions in the portal. If you have a Chase Freedom Flex, Ink Business Unlimited Credit Card, Ink Business Cash Credit Card or Chase Freedom Unlimited, all points are worth 1 cent each.

However, as noted previously, if you have multiple cards earning Ultimate Rewards points, you can combine your points into the account with the highest value for Ultimate Rewards bookings. For example, your points earned with the Chase Freedom Flex can be moved to your Sapphire Reserve account, thus increasing their value from 1 to 1.5 cents apiece. This is a generous offer from a credit card program.

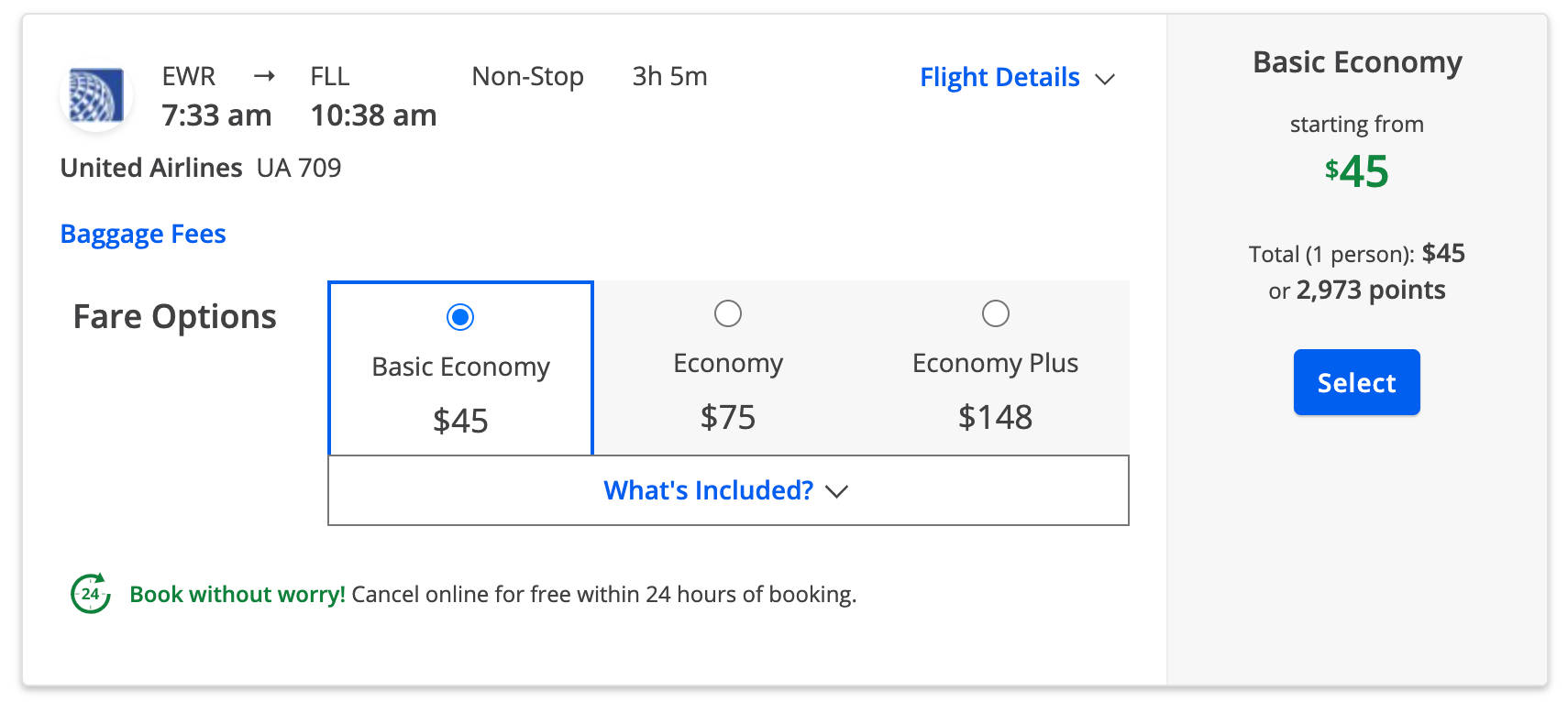

If you can find inexpensive airfare via Chase Travel, using your points for these flights can make sense to save cash. In the eyes of the airline, tickets booked this way are essentially the same as paid fares. This means you’ll earn elite status credits and redeemable miles. Be careful to avoid basic economy tickets unless you are OK with their restrictions.

In the case below, spending 2,973 Ultimate Rewards points from a Sapphire Reserve account to fly from Newark Liberty International Airport (EWR) to Fort Lauderdale-Hollywood International Airport (FLL) isn’t too shabby.

You might also consider the travel portal option if you only have a handful of Ultimate Rewards points left since Chase lets you redeem points to cover even just a portion of the trip cost. You would then pay the remaining balance with cash.

Finally, this is a decent option for car rentals, non-chain lodging and when cash rates make spending points through transfer partners a bad value. The hotel options are quite varied, though be aware that if you book a hotel that participates in a major loyalty program through Chase, you likely won’t earn hotel points, nor will you be able to take advantage of any elite status perks.

Enjoy fixed-value, non-travel redemptions

You can redeem Chase points for a statement credit or bank deposit at a flat rate of 1 cent each, and this rate also applies to gift cards and Apple products (outside a limited-time special).

However, with Chase Pay Yourself Back, you can redeem points for cash back at a rate of 1.25 to 1.5 cents each, depending on your card. This redemption rate is valid on statement credits toward rotating purchase categories, such as dining.

Finally, you can also link your eligible Chase cards to your Amazon account and pay for purchases with the Shop With Points program. However, you will only receive a value of around 0.8 cents per Ultimate Rewards point.

As you can see, you’ll generally get much better value with the program’s transfer partners and Chase Travel bookings. However, we know needs can change, so these non-travel redemptions remain fall-back options.

Bottom line

Chase Ultimate Rewards is one of our favorite credit card programs at TPG. It allows you to start with a credit card offering a large welcome bonus and then enjoy bonus points on many everyday spending categories — like airfare, hotels, dining and groceries. Then, you can choose from a huge range of transfer partners, redeem points for travel directly with Chase or choose cash back.