Editor’s note: This is a recurring post, regularly updated with new information.

Whether you’re a credit card rewards novice or a full-on expert, there are key tenets to follow.

As the saying goes, “Everyone makes mistakes,” and the points and miles game is no exception. Whether you’re brand-new to the hobby or a seasoned pro, the potential for errors is always there.

In this guide, I’m sharing my 10 “commandments” for travel credit cards to help you avoid some of the most common mistakes made by cardholders.

Thou shalt pay thy balance in full

Keeping a balance is a cardinal sin when it comes to credit cards.

Unfortunately, I know several people who treat credit limits like free money, spending at will without any definitive plan to pay the balance down. Aside from being a surefire way to wreck your credit score (and hurt your ability to open cards or obtain a mortgage or other loan in the future), this behavior will also cost you money.

Most rewards credit cards carry high-interest rates — although a few offer a 0% APR for an introductory period — so running up a balance and not paying it off every month will negate the value of any points or miles you earn.

How to comply

Whether you have one credit card or 20, always spend within your means and stay organized. I use an Excel spreadsheet to project out my bank account for at least three months, so I know that my outflows (payments, checks, etc.) never exceed my inflows (income).

Thou shalt not miss a payment

Though not nearly as bad as running a balance, missing payments can be very costly. For starters, most credit card issuers charge a late fee of $25-$35 if you submit a payment even a single day late. Although some credit cards may be willing to waive the fee for your first missed payment, you will still want to avoid it.

Payments made beyond your due date can also significantly affect your credit score. Your payment history makes up over one-third of your overall credit score, and while one missed payment isn’t fatal, several are a cause for concern.

Related: What to do if your credit card is delinquent — and how to prevent it from happening

How to comply

Take advantage of the automatic payment features available on just about every credit card.

When I open a new card, I set a calendar notification for four to six weeks later so I remember to add my bank account and/or set up automatic payments. Remember that there may be a one-to-two-month delay in activation, so you may have to manually make the first one or two payments before autopay kicks in.

Related: How to set up autopay for your credit cards

Thou shalt not cancel a card before thou hast opened a new one

Many people are surprised by how many credit cards I have, and I commonly get asked, “Don’t you need to cancel one card before opening another?” Absolutely not. In fact, canceling a card may actually hurt your credit score.

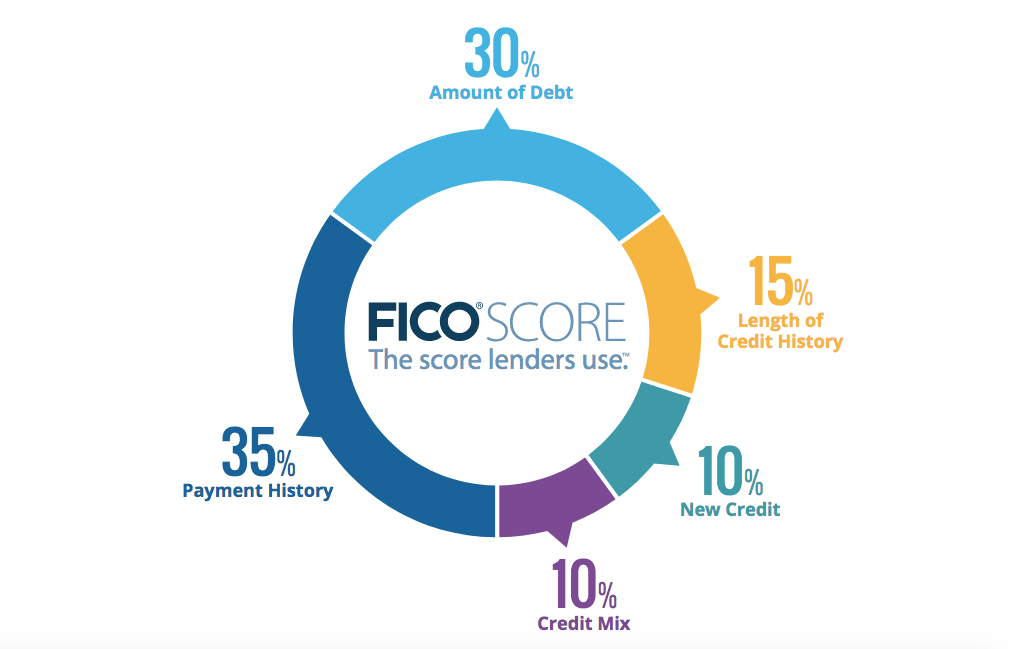

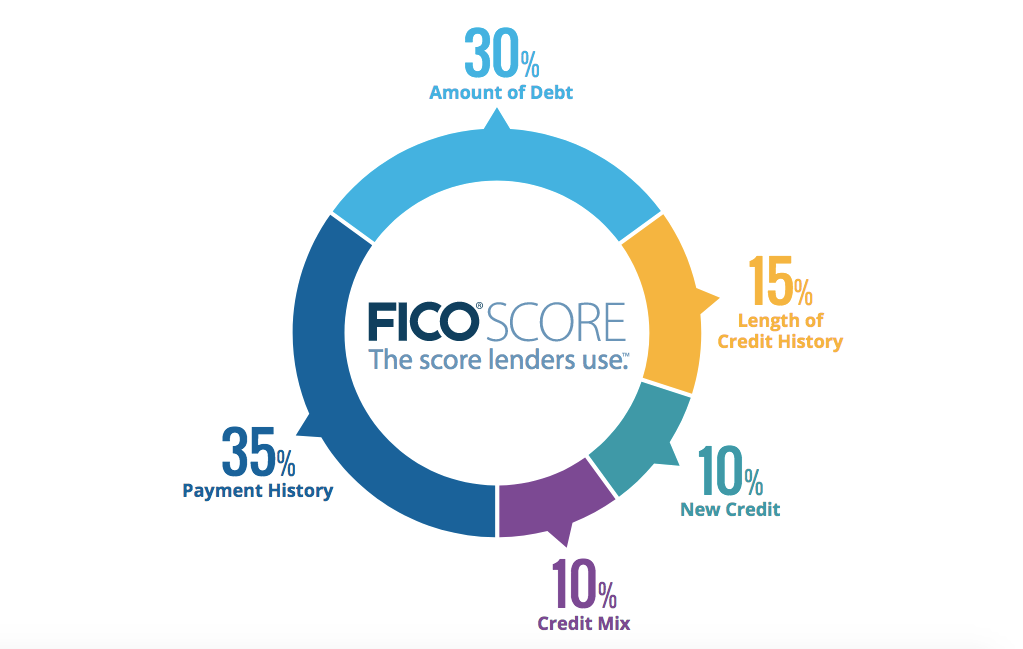

There are two main reasons for this. For one, a large part of your credit score (30%) consists of your credit utilization ratio, or how much of your available credit you actually use.

If you currently have balances of $5,000, and $50,000 of total available credit, your credit utilization rate is just 10%. If you then cancel a card with a $30,000 limit, your rate suddenly jumps to 25% (because your available credit is now just $20,000). That’s not quite in the danger zone, but is high enough to give a card issuer some doubts.

Secondly, another component of your credit score (10%) consists of your length of credit history, and part of this equation is the average age of your accounts. For example, if you’ve had a card with no annual fee for five or more years, do not cancel it. Make a few purchases on it each year (so the bank doesn’t close it) and let it continue to add to your history.

How to comply

Simply put, we recommend not canceling a card unless doing so won’t hurt your credit utilization rate. If the card has an annual fee that you want to avoid, try to downgrade the card to a no-annual-fee version instead of canceling the card.

Thou shalt not cancel a card and lose thy points and miles

Another hazard of canceling a credit card is forfeiting the points and miles you’ve earned.

This isn’t an issue for many credit cards connected to a specific airline or hotel chain, as what you earn automatically is credited to your loyalty account with that program. However, other points and miles simply sit with the card issuer until you redeem them, including American Express Membership Rewards points and Chase Ultimate Rewards points.

Be sure to redeem before canceling cards with these types of rewards, as they will disappear once your account is closed.

How to comply

Use the points before canceling the card, either by transferring them to a partner or redeeming them directly for travel, statement credits, etc.

Thou shalt not allow thy rewards to expire

While some loyalty programs (such as JetBlue, Delta and United) don’t put an expiration date on rewards, others will wipe out your account after a certain period of inactivity.

That period is generally at least 24 months, though it can be shorter.

How to comply

Check out TPG’s tips on how to keep your points and miles from expiring. To be safe, I always recommend making at least one purchase annually on every card in your wallet and earning points or miles through a shopping portal for any types of points or miles for which you don’t have an associated credit card.

Thou shalt not miss out on a welcome bonus

Using a rewards or travel credit card for day-to-day spending is a great way to boost your earnings throughout the year, but one of the biggest drivers of credit card applications is the sign-up bonus.

You can miss out on a huge influx of points by not spending enough in the specified time frame (usually three to six months). Some things to keep in mind when it comes to these requirements:

- The clock usually starts ticking as soon as your application is approved: The time frame to hit the bonus usually doesn’t start when you receive the card; rather, it begins immediately upon account approval. If you’re unsure of that date, call customer service for your card and ask.

- Annual fees, transferred balances and cash advances do not count: For instance, if you got in on the latest offer for The Platinum Card® from American Express, the $695 annual fee (see rates and fees) will not help you hit the minimum spending threshold.

How to comply

Knowing the specific time frame and what counts is half the battle, but you also need to track spending. Spreadsheets, calendar reminders and money management tools can be very helpful for staying organized.

Related: The best time to apply for these popular travel credit cards based on offer history

Thou shalt take advantage of category bonuses

Many credit cards give you bonuses for purchases at certain merchants, including restaurants, supermarkets and gas stations. For instance, I shudder when my friend pays for their dinner with a 1% cash-back card instead of the Chase Sapphire Preferred Card or Chase Sapphire Reserve, both of which earn bonus Chase Ultimate Rewards points on dining purchases.

If you have a card with bonus categories, be sure to use that card when making purchases in these categories.

Related: The best rewards credit cards for each bonus category

How to comply

Reading the card agreement (or visiting the card’s website) to know the earnings and benefits provided by your current cards is a great first step. You can also check out our guide to the best cards for each bonus category if you want a new card for a particular spending category.

Thou shalt not ignore cards with annual fees

If you’re new to this hobby, you may believe (as I once did) that cards with an annual fee are terrible.

However, many of these cards offer lucrative sign-up bonuses, ongoing benefits and anniversary bonuses that more than cover the annual fee. In addition, many of them waive the annual fee for the first year, giving you a free one-year trial before deciding whether to keep the card for the long term.

Related: The complete guide to credit card annual fees

How to comply

By visiting TPG, you’ve already taken the first step. Our expert analysis will help you maximize your earnings and rewards on these cards, including TPG’s monthly ranking of the top limited-time credit card offers. You can also check out our best credit cards page for a list of these (and other) great offers.

Thou shalt pursue retention bonuses

Once you take the plunge and open a card with an annual fee, there are still ways to avoid the annual fee.

If you don’t think the value you’ve received from the card justifies the annual fee, you can always call your card issuer when the annual fee comes due and ask about waiving the annual fee.

Remember that the issuing bank wants you as a customer, so it doesn’t want you to close your account. Many TPG readers (myself included) have received offers to keep cards open, including:

- A waived annual fee (no strings attached).

- Make X purchases in Y months and enjoy a waived annual fee.

- Make X purchases in Y months and receive Z bonus points or miles.

- Z bonus points or miles (no strings attached).

Related: Pros and cons of downgrading your credit cards right now

I recommend doing this only for cards that you would cancel without getting an offer.

How to comply

Call the number on the back of your card when the annual fee comes up, and tell them that you’d like to cancel the card due to the annual fee. Then, see what happens.

Related: My Amex Platinum retention bonus: 20,000 Membership Rewards points

Thou shalt not pay foreign transaction fees

Many credit cards charge you a fee (generally 1%-3%) for every purchase you make in a foreign currency or country. This includes purchases made abroad that the merchant converts to dollars for you (which you should never accept, by the way).

But some credit cards waive these fees. Several premium travel rewards credit cards don’t have foreign transaction fees. Even some no-annual-fee cards (see rates and fees) like the Capital One VentureOne Rewards Credit Card waives foreign transaction fees (see rates and fees).

How to comply

This one is simple: Get a card that waives these fees. Here are the best credit cards with no foreign transaction fees.

Bottom line

There are many things that you absolutely should (and should not) do concerning your travel rewards credit cards. Hopefully, this list of commandments has given you some food for thought, whether you’re looking for one of the best cash-back credit cards or a premium travel rewards card.

Using the points, miles or cash back to manifest a nice vacation will deliver a gratifying feeling. However, it’s essential to make the most of every card you open and use it regularly.

For rates and fees of the Amex Platinum Card, please click here.