Editor’s note: This is a recurring post, regularly updated with new information and offers.

If things go awry while you’re traveling, you’ll be glad that you booked your trip — and its related expenses — with a card that features travel protections. Thankfully, many rewards credit cards offer complimentary protections as long as you pay for prepaid, nonrefundable travel expenses with the card.

For example, the Chase Sapphire Preferred® Card is a popular travel rewards card with a reasonable $95 annual fee. Among its great travel benefits are trip cancellation and interruption insurance and trip delay reimbursement.

These protections offer a substantial level of coverage that may prevent the need for purchasing separate travel insurance. With the Sapphire Preferred, if your trip is delayed 12 hours or more — or requires you to book overnight accommodations — you’re covered for related expenses, up to $500 per ticket.

Let’s examine the coverage you get with travel rewards cards, using the Sapphire Preferred’s benefits as our primary example. Remember that protection and coverage vary from card to card, so carefully review the fine print for the specific cards you hold (or plan to apply for) before booking your next adventure.

Trip cancellation and interruption insurance

First, let’s quickly go over trip cancellation and interruption insurance on the Sapphire Preferred, as outlined by Chase:

“If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.”

If the airline, hotel or tour operator does not refund you for your prepaid travel expenses, that’s when you can file a claim under trip cancellation and interruption insurance to get reimbursed for these costs.

Note that you won’t get reimbursed for any new travel accommodations made because of the cancellation or interruption.

Related: The best travel insurance policies and providers

Trip delay reimbursement

The terms are similar for trip delay reimbursement on the Sapphire Preferred:

“If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.”

As with the trip cancellation and interruption insurance, the trip delay policy only offers reimbursement for specific expenses, which are outlined as “reasonable additional expenses incurred for meals, lodging, toiletries, medication and other personal use items due to the covered delay.”

Therefore, you can expect to get reimbursement for essential items that you have to purchase as a result of the delay. However, this does not mean you can reserve a new flight on a different carrier and still get reimbursed.

Remember to keep the $500 per ticket limit in mind.

Related: Flight canceled or delayed? Here’s what to do next

Will trip insurance cover the cost of my new flight?

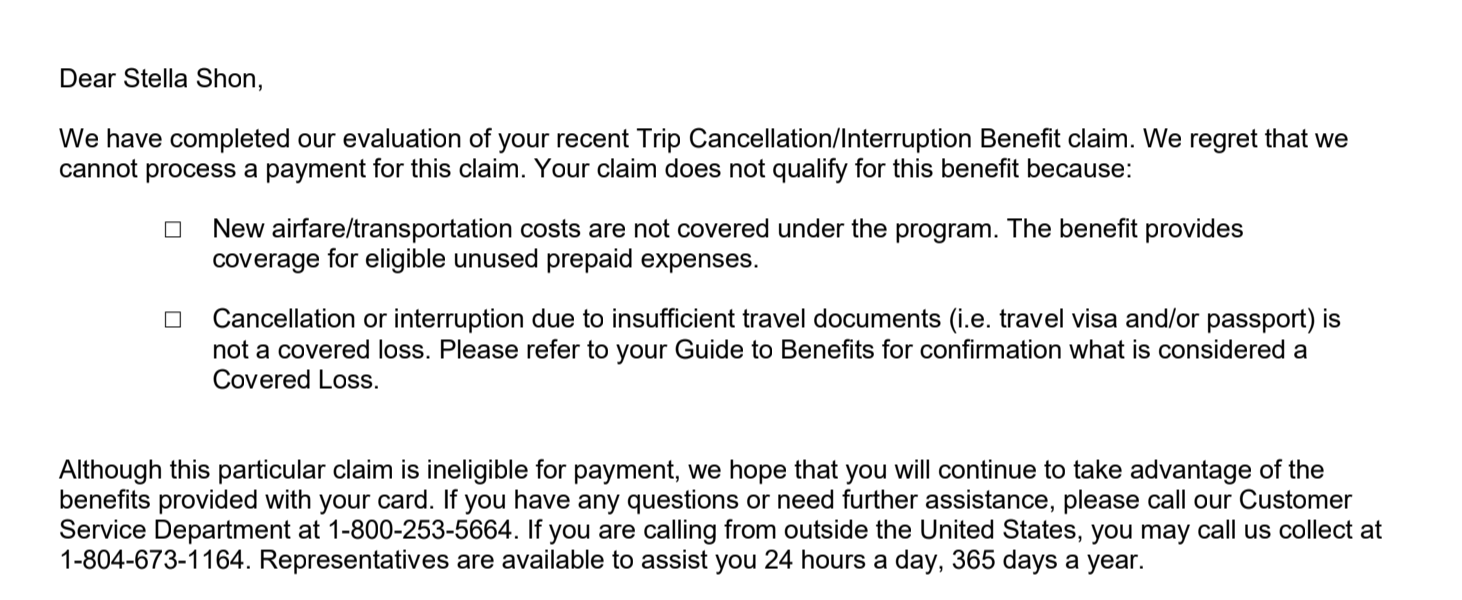

In short, the answer is no. Whether you file a claim under trip cancellation and interruption insurance or trip delay reimbursement, you will not get reimbursed for new airfare.

That means if you buy a $100 United flight that gets canceled (or delayed) and you end up purchasing another $300 flight on Delta instead, the cost of the new Delta airfare will not be covered for reimbursement.

I learned this the hard way on a solo trip to Europe when my flight from Italy to Greece was canceled. I rebooked and thus rerouted myself through an airport two hours away.

After buying a new flight, hopping on a bus and waiting patiently in the terminal for the next flight, I tried filing a claim with my Chase Sapphire Preferred.

This may seem frustrating, but trip cancellation and interruption insurance will still reimburse you for prepaid, nonrefundable expenses.

Related: How to reach airline customer service quickly

Bottom line

It’s great that many travel credit cards come with benefits like trip cancellation and interruption insurance and trip delay reimbursement, but it’s important to read the terms and conditions to know what exactly these benefits do and do not cover.

While these protections may be sufficient for most travelers, those who want higher coverage should seriously consider buying travel insurance that offers more protection or “cancel for any reason” coverage.

Related: New airline rules are in effect — here’s what you should know