There are plenty of travel rewards cards vying for your attention, but one of my favorite cards is the IHG® Rewards Premier Credit Card.

The IHG Rewards Premier card offers a compelling sign-up bonus to attract new cardholders. The card is also a good option to keep long-term due to its many perks that can easily offset its modest $99 annual fee. Here’s why I love the IHG Rewards Premier card and plan to keep it in my wallet for the foreseeable future.

Sign-up bonus

The IHG Rewards Premier Credit Card is currently offering its best-ever sign-up bonus of 175,000 bonus points after spending $3,000 in the first three months of account opening. Based on TPG’s valuations, 175,000 IHG points are worth about $875.

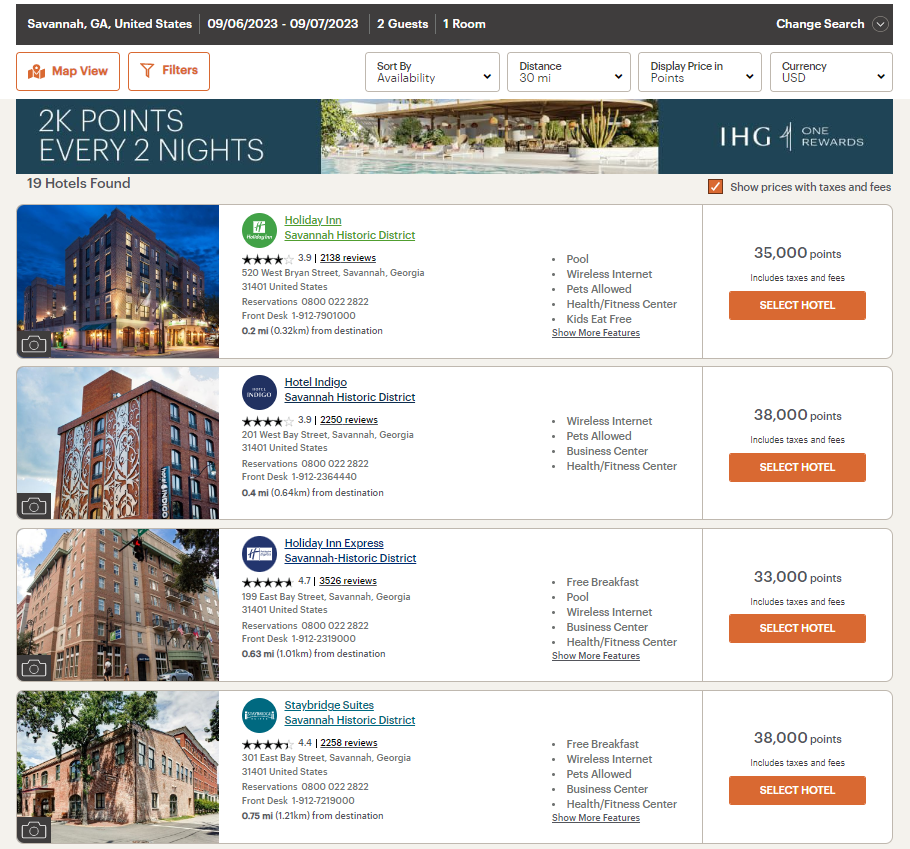

IHG One Rewards uses dynamic award pricing, so the number of award nights you’ll get from 175,000 points will depend entirely on when and where you want to redeem your points.

Note that the IHG Rewards Premier card and its sign-up bonus aren’t available if you are a:

- Current cardmember of any personal IHG Rewards Credit Card.

- Previous cardmember of any personal IHG Rewards Credit Card, and you received a new cardmember bonus for a personal IHG Rewards Credit Card within the last 24 months.

Chase’s 5/24 rule may also prevent you from being approved for a new Chase card. Check out our post on calculating your 5/24 standing for more information.

Related: Is the IHG Rewards Premier card worth the annual fee?

Anniversary night

Even if you don’t spend many nights in hotels or prefer a different hotel loyalty program, the IHG Rewards Premier Credit Card can still be worth its $99 annual fee each year. After all, most cardholders can get more than $99 of value each year from one benefit: the anniversary night you receive after each account anniversary.

You can use the anniversary night for a night with a redemption rate of 40,000 points or less. But you can also add-on points from your IHG Rewards account to redeem for a night costing more than 40,000 points. You must redeem your night and complete your stay within 12 months of the free night’s issue date.

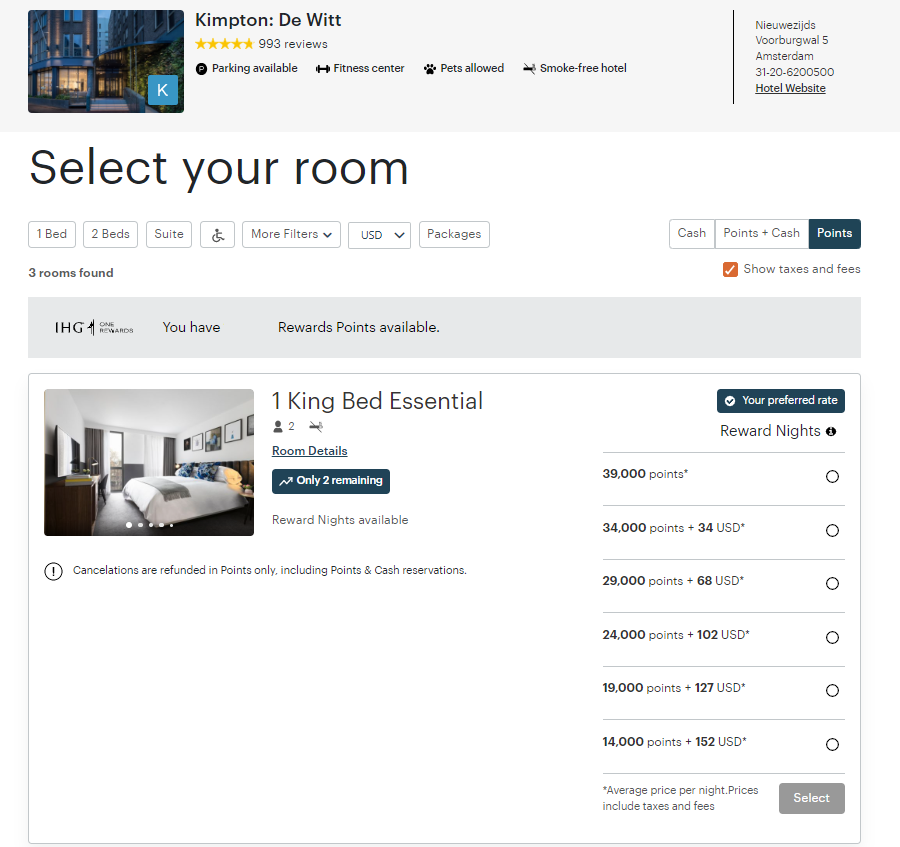

I’ve gotten good value from my anniversary nights over the years. For example, I’m writing this story during a stay at the Kimpton De Witt in Amsterdam that I booked using several anniversary free nights. The award rate on my nights was 40,000 points, while the paid rate would have been about $281 per night. Even ignoring the paid rate, I was happy to trade several anniversary nights to stay at this Kimpton near Amsterdam Centraal.

But you can also get enough value from your anniversary night to justify the card’s annual fee closer to home. Although finding nights costing less than $99 in many U.S. cities is becoming less common, you’ll still often find IHG award nights for 40,000 points or less.

There are many different ways to use the anniversary night. But as long as you’re getting more than $99 of value from your anniversary night each year, keeping the IHG Rewards Premier card long-term likely makes sense — especially once you consider the card’s other valuable perks.

Related: The 19 best IHG hotels in the world

Fourth-night reward perk

My favorite perk of the IHG Rewards Premier Credit Card is the “redeem three nights, get fourth reward night free” benefit. In short, this perk lets you pay zero points for every fourth night when you redeem IHG points for a stay of four nights or longer.

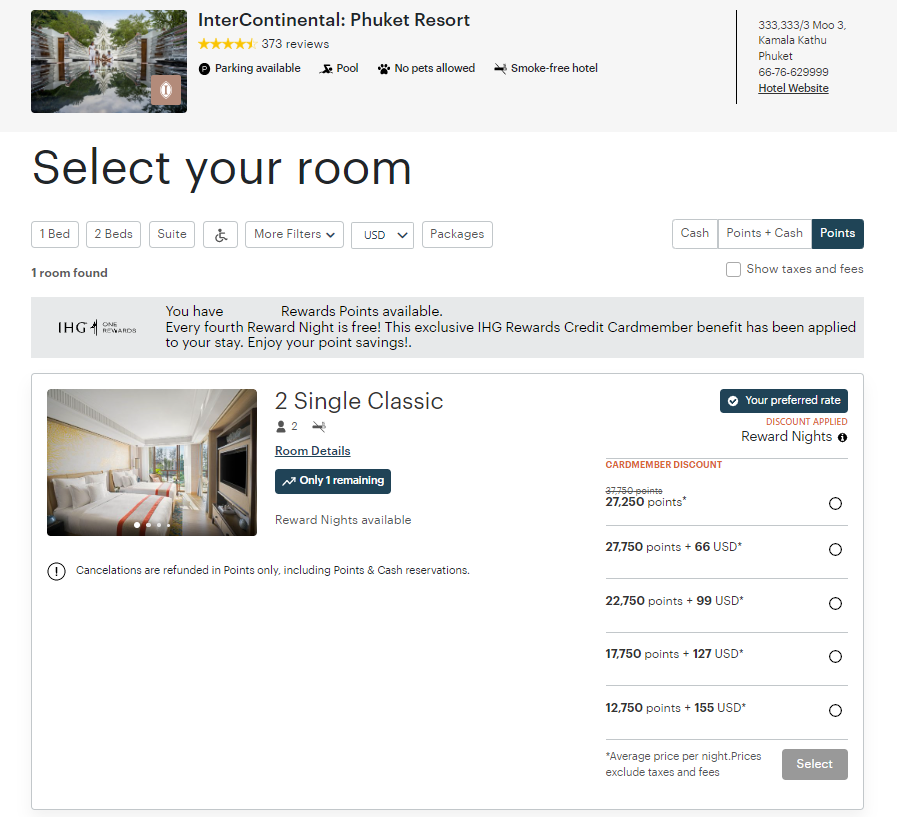

Let’s look at an example. For this stay at the InterContinental Phuket Resort in Thailand, I could pay an average of 27,250 points per night (instead of 37,750 points per night) due to the fourth-night reward perk.

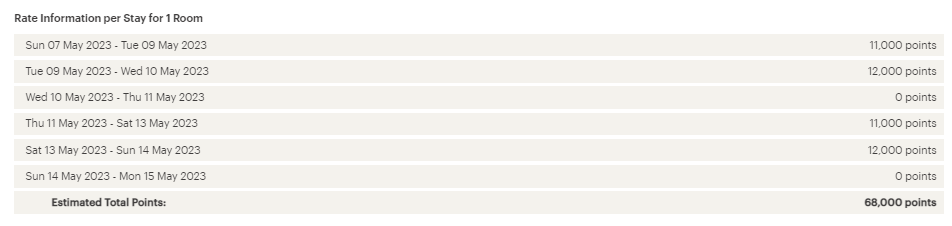

This perk also works for longer stays. For example, here’s an eight-night stay where two nights would cost zero points after the fourth-night reward perk. (Note that the first and fourth lines in the screenshot below pool two nights together as they’re all priced at 11,000 points each.)

You can use this benefit an unlimited number of times and for longer stays. For example, you’ll receive the fourth, eighth and twelfth nights free on a 12-night stay. And it will always be those nights that are free, regardless of whether those nights are the cheapest or most expensive of the whole stay.

For example, on a four-night stay where the nights are priced at 10,000 for each of the first three nights and 12,000 on the fourth night, that fourth night will be free even though it’s priced the highest.

Most travelers will only use this perk a few times a year, but I’ve benefited from over 35 fourth-night rewards in the past six years. If you frequently redeem IHG points for stays of four nights or longer, this card benefit will likely save you a significant amount of points.

Related: What is IHG One Rewards elite status worth?

Other valuable benefits

The IHG Rewards Premier card includes several other valuable perks. For example, the card earns 10 points per dollar spent at IHG hotels and resorts, a return of 5% based on TPG’s valuations. The IHG Rewards Premier card also earns 5 points per dollar spent on purchases at gas stations, on other travel and at restaurants and 3 points per dollar spent on all other purchases.

Plus, the IHG Rewards Premier card offers the following benefits:

- Automatic IHG One Rewards Platinum Elite status for as long as you keep your IHG Rewards Premier card.

- Earn IHG One Rewards Diamond Elite status through the end of the following calendar year during any calendar year you make purchases totaling $40,000 or more with your IHG Rewards Premier card.

- Save 20% on points purchases when you pay with your IHG Rewards Premier card. You can’t combine this discount with any other points purchase offers, though. So, you’ll typically do better waiting for an IHG buy points promotion instead of saving 20% through this perk.

- No foreign transaction fees.

- Get a Global Entry, TSA PreCheck or Nexus credit of up to $100 every four years as reimbursement for an application fee charged to your card.

- Earn a $100 statement credit and 10,000 bonus points any calendar year you spend at least $20,000 in purchases.

- Get a $25 United TravelBank cash deposit in your United MileagePlus account twice a year (on or around Jan. 1 and July 1) once you complete a one-time registration for this perk.

Platinum Elite status will get you some useful perks when you stay at IHG hotels, including more bonus points on paid stays and complimentary upgrades (subject to availability and at the hotel’s discretion).

Related: The best hotel credit cards with annual fees under $100

Bottom line

The IHG® Rewards Premier Credit Card is currently offering its best-ever sign-up bonus of 175,000 bonus points after spending $3,000 in the first three months of account opening. Based on TPG’s valuations, these bonus points are worth $875.

And once you have the IHG Rewards Premier card, two card benefits — the anniversary night certificate and the fourth-night-reward perk — should provide significantly more value than the $99 annual fee each year. As such, I believe the IHG Rewards Premier card is a valuable card to get and then keep year after year.

Check out our full IHG Rewards Premier Credit Card review for more details.

Official application link: IHG® Rewards Premier Credit Card