Citi is a TPG advertising partner.

It’s one of our favorite cards here at The Points Guy. The simple earning structure and no annual fee make the Citi® Double Cash Card one of the best credit cards for everyday spending. And now that the card earns ThankYou Points — not just cash back — it’s more valuable than ever.

Usually, the major, persistent downside to the Double Cash card is its lack of a sign-up bonus. Luckily, that’s not the case right now. However, we’ve received word that this limited-time offer is ending soon, so we highly recommend that you go ahead and snag it while you still can.

Let’s look at the current welcome offer on the Double Cash card.

Citi® Double Cash Card sign-up bonus

For a limited time, new applicants can earn $200 in cash back after spending $1,500 on purchases in the first six months from account opening. This welcome bonus represents a 13.33% return on spending.

Since the spending requirement for the Double Cash card‘s welcome bonus is spread out over six months, you can spend an average of $250 per month over these six months to earn the bonus. Plus, there’s no annual fee on the card.

Benefits of the Double Cash card

Rather than keeping track of complicated bonus categories on your credit card, the Double Cash card makes it simple.

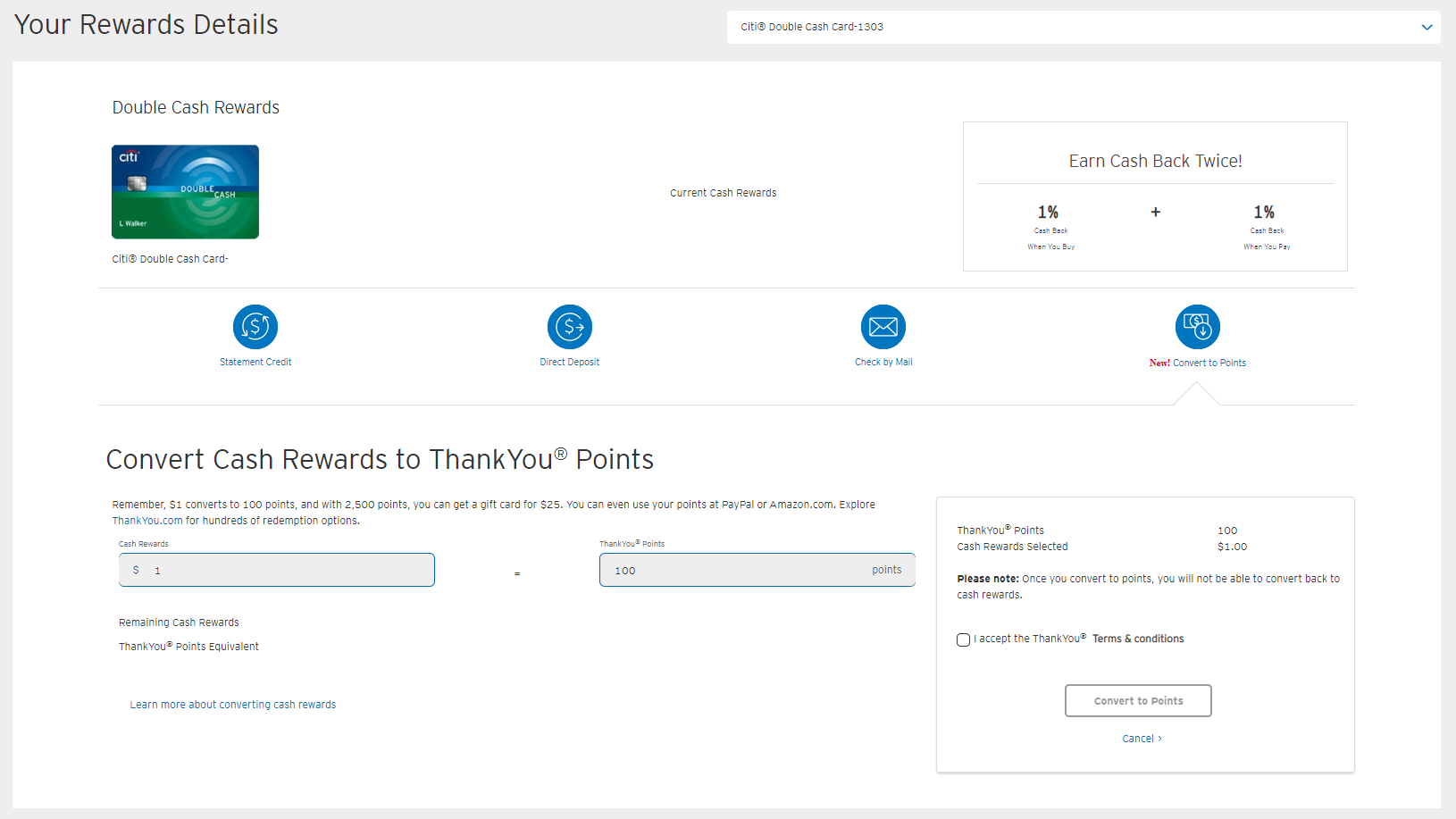

You’ll earn 1 ThankYou Point per dollar on each purchase. Then you’ll earn another point per dollar when you pay your credit card bill. In this way, you can earn 2 points per dollar on purchases without needing to do any math or pay an annual fee. There are no limits to how many rewards you can earn on purchases with the Double Cash card each year.

Since the Double Cash card has no annual fee, its perks are quite subdued. However, cardholders still receive the following benefits:

- Contactless payment with your contactless-chip enabled Citi card.

- Access to Citi Entertainment, which provides special access to purchase tickets to thousands of events.

- ID theft protection that helps eliminate the worry of identity theft by monitoring and alerting cardholders if suspicious activity is found.

- The free services of Citi Identity Theft Solutions if your personal information has been stolen to commit fraud or theft.

You will pay a 3% foreign transaction fee if using your Double Cash card for purchases not made in U.S. dollars, so it’s best to use one of these cards which don’t charge foreign transaction fees when traveling abroad.

Cardholders can redeem their earnings for cash back, Shop with Points, gift cards and travel. Note that if the only ThankYou Points-earning card you have is the Double Cash, you only have access to three transfer partners: Choice Privileges, JetBlue TrueBlue and Wyndham Rewards.

However, if you have another card that earns ThankYou Points — such as the Citi Premier® Card — you will gain access to the full range of Citi’s transfer partners. This includes 18 airline and hotel partners with which you can use your points.

Related: How to redeem Citi ThankYou points for maximum value

New applicants to the Double Cash card can also take advantage of an introductory 0% APR on balance transfers for 18 months after the introductory period, your variable APR will be 17.74%-27.74%, based on your creditworthiness.

Click here to read our full review of the Double Cash card.

Bottom line

The current sign-up bonus on the Double Cash card is listed as a limited-time offer. It will be ending soon, so act now if you’re interested in taking advantage of it.

If you’ve been considering the Double Cash card as a great everyday spending credit card but were deterred by its lack of welcome bonus, now is a great time to apply.

Official application link: Citi® Double Cash Card with a $200 cash back offer after spending $1,500 on purchases in the first six months from account opening.