Editor’s note: We’ve updated this post with new information. TPG founder Brian Kelly is a Bilt advisor and investor.

Despite being shorter than some domestic routes, flights to the Caribbean, Mexico and Central America can be expensive. In addition to the extra taxes and fees, many airlines charge higher award rates for these routes.

But you can sometimes book cheap flights to the Caribbean, Mexico and Central America with American Airlines. Following the steps below, you might find awards to these regions for relatively few American Airlines miles.

Why it’s special

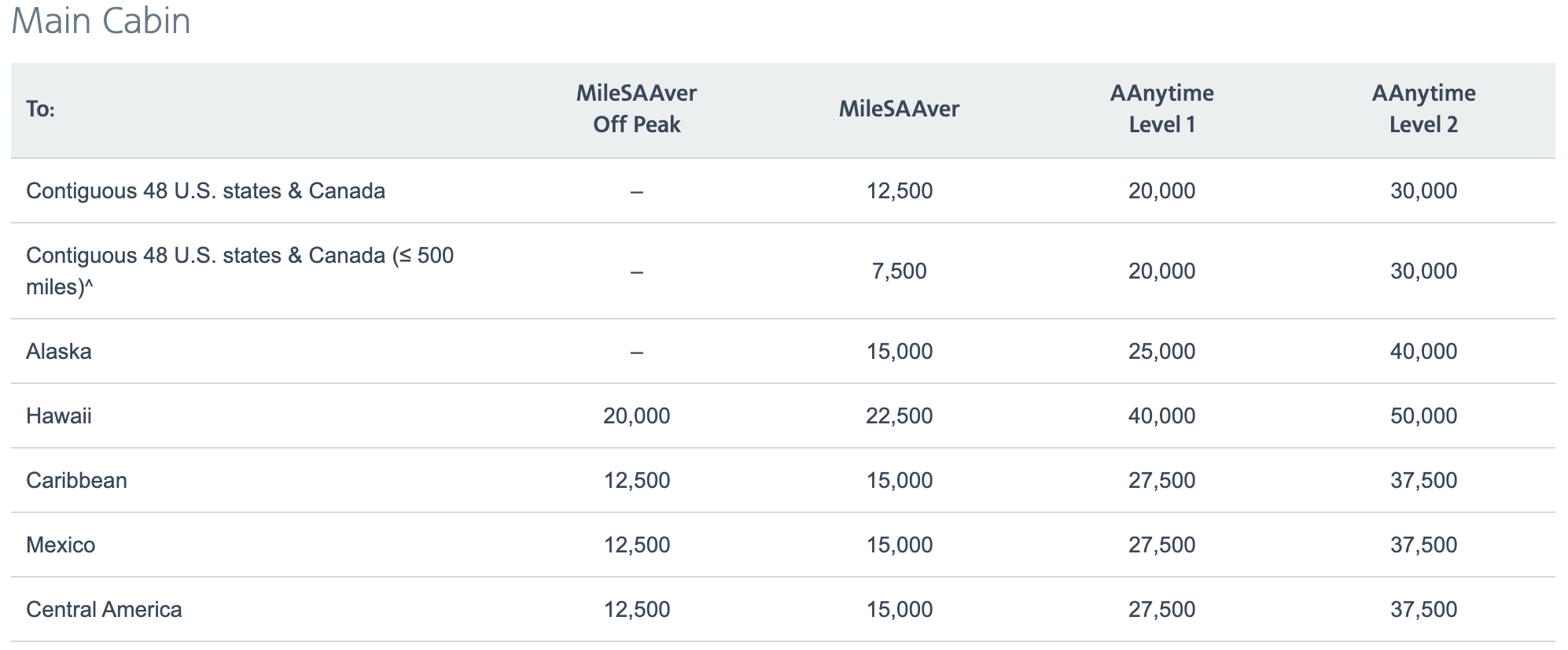

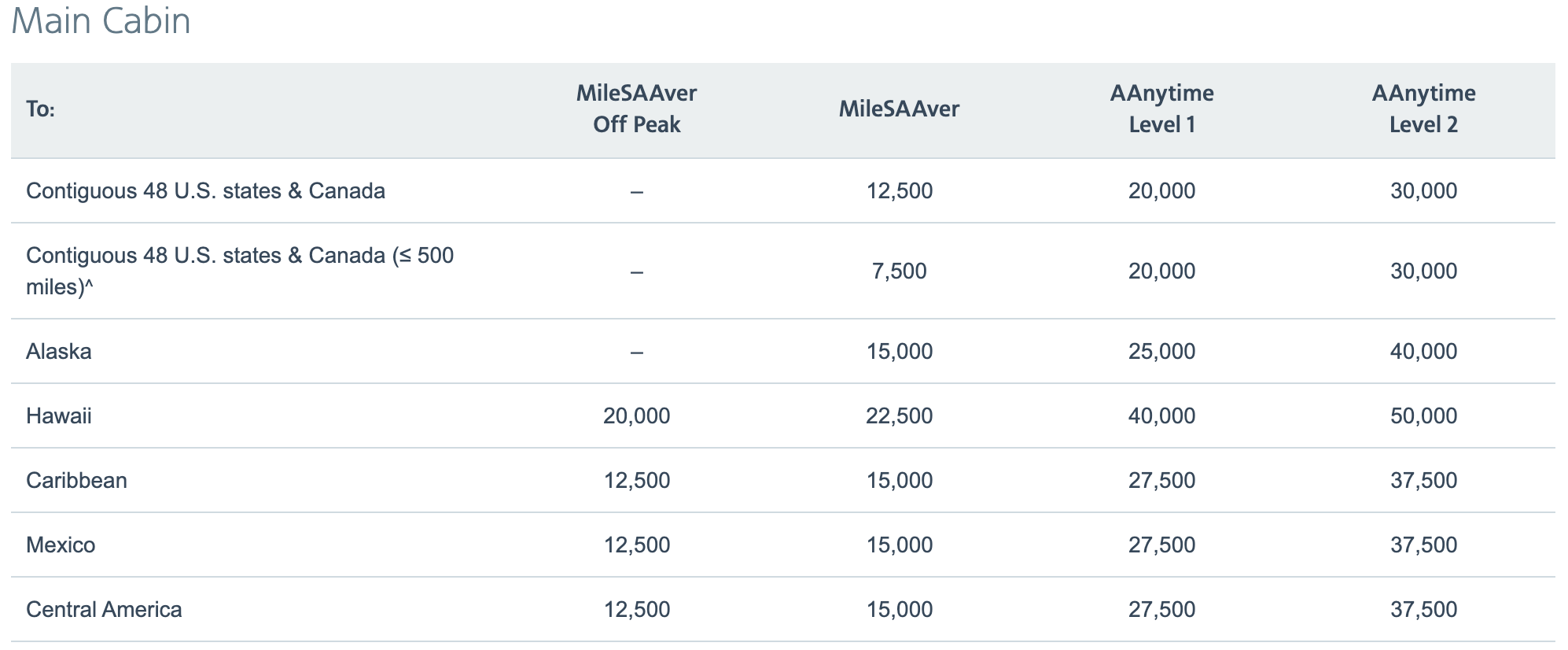

American Airlines AAdvantage will soon offer fully dynamic mileage awards and introduce a simplified award chart for travel on its flights. But, for now, you can still book MileSAAver off-peak awards to select regions. These awards let you save on economy awards between certain regions during select travel periods.

MileSAAver awards to the Caribbean, Mexico and Central America typically cost 15,000 AAdvantage miles each way in economy but are available for just 12,500 miles on off-peak dates.

The discount is applied automatically, so you can book these awards even if you don’t have enough miles at the standard rates.

There are some terrific destinations you can book at these discounted rates, including San Jose, Costa Rica (SJO), Panama City (PTY), Aruba (AUA), Barbados (BGI), Bermuda (BDA), Mexico City (MEX) and Cancun (CUN).

How to book this award

Booking an off-peak MileSAAver award is no different than any other AAdvantage redemption. However, you must familiarize yourself with the off-peak dates to know when to book.

The current off-peak dates for the Caribbean, Mexico and Central America are April 21 to May 20 and Sept. 9 to Nov. 18. Keep in mind that the fall dates are during peak hurricane season for some of the destinations, so you’ll want to pay the taxes and fees with a credit card that comes with travel protections.

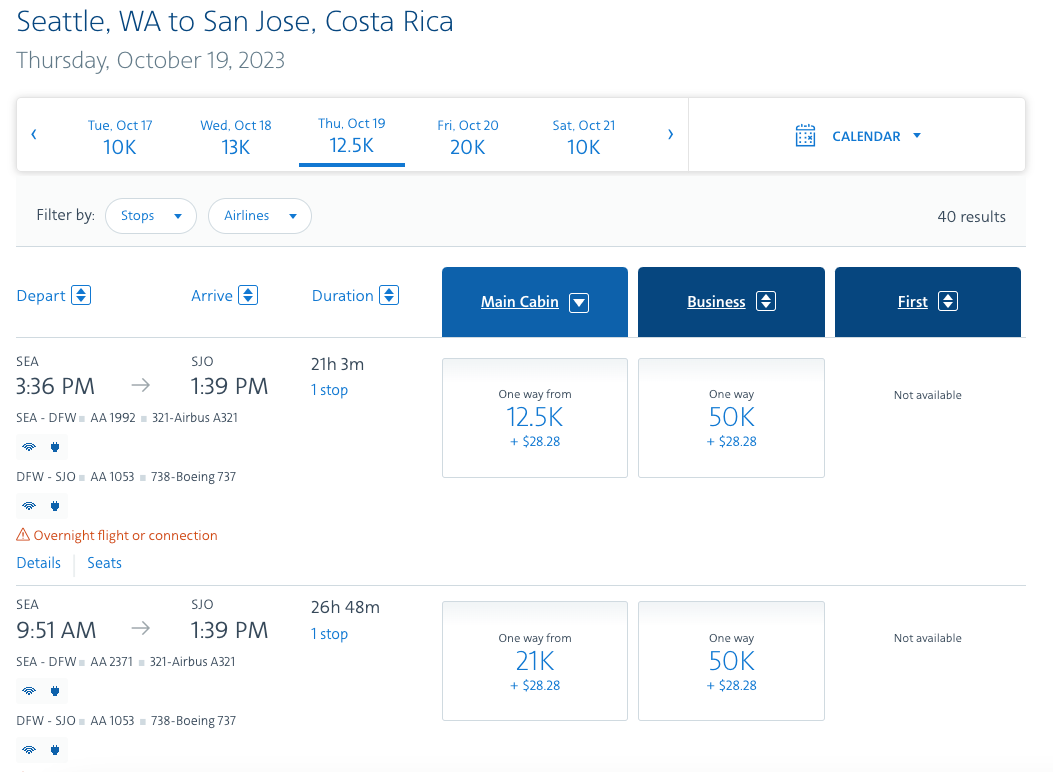

Once you’ve picked your dates, search as you normally would on the American Airlines website. Enter your route, select your dates and check off the “Redeem miles” box.

If there is MileSAAver availability, you’ll automatically see the lower rates — no promo code needed. Just remember that the discount is only available for economy class, not business or first.

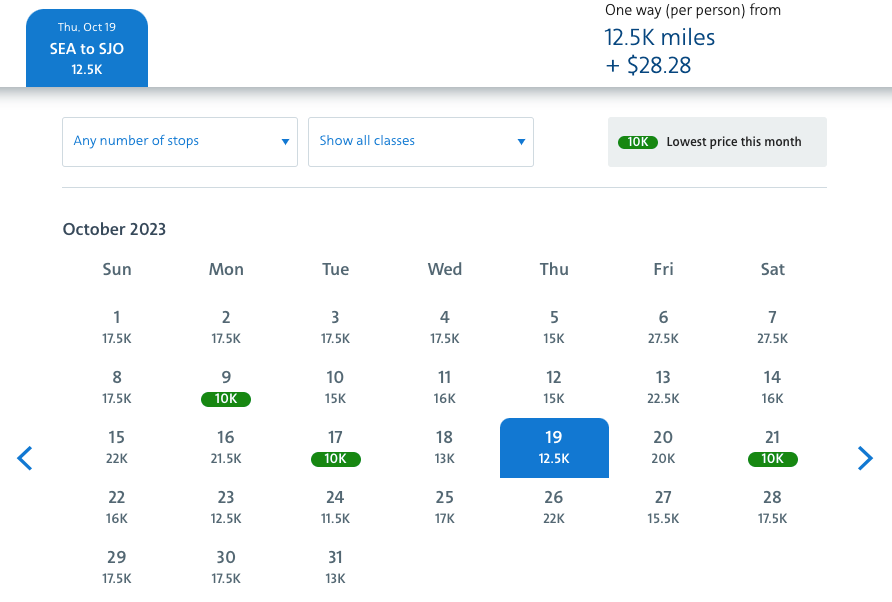

If there’s no MileSAAver availability, I recommend you use the calendar search tool to check alternate dates. Unfortunately, MileSAAver off-peak awards do require you to fly American Airlines. So, you won’t be able to get these rates if you connect through a partner airline like Alaska.

As American Airlines prices awards dynamically, we found some dates priced even lower than the expected off-peak MilesSAAver rate. If you are flexible, you may be able to book these awards for only 10,000 miles (plus taxes and fees) each way.

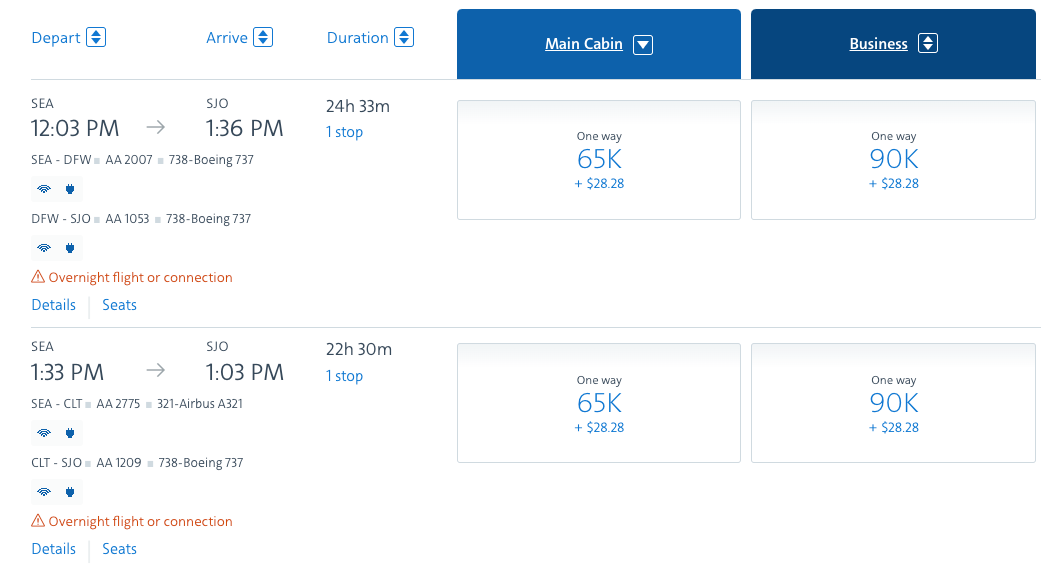

The downside of dynamic pricing is that for peak periods, American charges far more than these prices. For example, we found some one-way economy awards to Costa Rica pricing as high as 65,000 miles plus $28.28 in taxes and fees.

After you’ve selected a flight, you’ll need to log in to your AAdvantage account to complete the booking. Some of the best cards for paying taxes and fees on award tickets include The Platinum Card® from American Express and the Chase Sapphire Reserve. Not only do they earn bonus points on airfare, but they come with trip delay reimbursement — which is especially important if you’re traveling during hurricane season.

Related: Maximizing redemptions with American Airlines AAdvantage

How to earn miles for this award

You might wonder how to earn enough miles for this award if you’re not a frequent American Airlines flyer. At first, this might seem challenging since American isn’t a transfer partner of American Express Membership Rewards, Capital One, Chase Ultimate Rewards or Citi ThankYou. However, there are plenty of other ways to earn AAdvantage miles.

Earning American miles with cards

Two major transferable currencies partner with American Airlines: Bilt Rewards and Marriott Bonvoy. Bilt Rewards transfer to Marriott at a 1:1 ratio, while you can transfer Marriott points to American Airlines AAdvantage at a 3:1 transfer ratio. To earn Marriott points, consider adding the Bilt Mastercard® (see rates and fees) or a Marriott Bonvoy credit card to your wallet.

A potentially simpler way of racking up AAdvantage miles would be by picking up and spending on an American cobranded credit card. In addition to giving your AAdvantage account a nice boost, some American Airlines cobranded cards provide valuable “elite-lite” perks ranging from free checked bags on domestic itineraries to lounge access.

Other methods for earning American miles

You don’t necessarily have to get a new credit card to earn the miles you need. While typically at suboptimal rates, you could also transfer World of Hyatt points, IHG One Rewards points and Choice Privileges points to American AAdvantage.

Alternatively, you could shop online through the AAdvantage eShopping portal or dine through AAdvantage Dining. You could also buy American Airlines miles, but this could sometimes be more costly than buying the flight outright.

For more options, read our complete guide on earning American Airlines miles.

Related: What is American Airlines elite status worth?

Bottom line

American Airlines AAdvantage will soon eliminate its MileSAAver and AAnytime awards, going all-in on dynamically priced flight redemptions. But as of publishing, you can still book off-peak MileSAAver awards. And as we noted in this story, you’ll find even cheaper pricing on some dates due to dynamic pricing.

For rates and fees of the Bilt Mastercard, click here.

For rewards and benefits of the Bilt Mastercard, click here.

Additional reporting by Ben Smithson.