Editor’s note: This post has been updated with new information.

For most people, when they think of large-scale hotel chains, Marriott and Hilton are usually the first to come to mind. However, while Marriott and Hilton earn more annual revenue, Wyndham Hotels & Resorts is actually the world’s largest hotel franchising company by the number of properties, with more than 9,000 hotels in over 90 countries on six continents.

Wyndham’s impressive portfolio of 22 brands and its vast U.S. footprint is validated by the claim “chances are, you’re about 10 minutes from a hotel by Wyndham,” as declared in its marketing slogan. Along with locations worldwide and an impressive portfolio of budget and midscale brands such as Days Inn, La Quinta, Wyndham and many more, the Wyndham Rewards loyalty program offers a straightforward way to redeem points at thousands of hotels, vacation club resorts and vacation rentals globally.

In 2020, Wyndham and Barclays revealed a refresh of their cobranded credit card lineup featuring the no-annual-fee Wyndham Rewards Earner® Card, the Wyndham Rewards Earner® Plus Card, and the Wyndham Rewards Earner® Business Card. The latter was the first Wyndham credit card created specifically for small businesses.

The information for the Wyndham Rewards Earner Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Given these three distinctive Wyndham card options issued by Barclays, you might be wondering which one will be best for your needs. Here’s a glance at the differences between them, so you can make the right choice based on your spending habits and travel goals.

In This Post

Wyndham credit cards

Wyndham Rewards Earner® Card

Sign-up bonus: Earn 30,000 bonus points after spending $1,000 on purchases in the first 90 days.

Earning rate: Earn 5 points per dollar on eligible Hotels by Wyndham and gas station purchases, 2 points per dollar on dining and grocery store purchases (excluding Target and Walmart) and 1 point per dollar on all other purchases.

Benefits: Wyndham Rewards Gold status, which includes free Wi-Fi, preferred room selection and late checkout. Opportunity to earn 7,500 bonus points each anniversary year after you spend $15,000 on eligible purchases. A 10% points discount on redemptions for free nights, and no foreign transaction fees.

Annual fee: $0.

Analysis: Built for the traveler that occasionally stays at Wyndham properties, this no-annual-fee card may provide you with useful benefits alongside your stay. Aside from earning 5 points per dollar at Wyndham properties and at gas stations, it earns a solid 2 points per dollar on grocery stores (excluding Target and Walmart) and dining purchases.

With standard free night awards starting at 7,500 points per night, the welcome offer of up to 30,000 bonus points can easily cover multiple hotel nights on your next vacation. Since TPG values Wyndham Rewards points at 1.1 cents each, this sign-up bonus is worth $330 — a decent offer from a no-annual-fee hotel card.

If you seldom stay at Wyndham hotels but want to dip into Wyndham Rewards, the no-annual-fee Wyndham Rewards Earner® Card may be ideal for you. On the other hand, if you spend several nights a year at Wyndham properties, there’s considerably more value to be had with the Wyndham Rewards Earner® Plus Card.

Official application link: Wyndham Rewards Earner® Card

Wyndham Rewards Earner® Plus Card

Sign-up bonus: Earn 45,000 bonus points after spending $1,000 on purchases in the first 90 days.

Earning rate: Earn 6 points per dollar on eligible Hotels by Wyndham purchases and gas station purchases, 4 points per dollar on dining and grocery store purchases (excluding Target and Walmart) and 1 point per dollar on all other purchases.

Benefits: Wyndham Rewards Platinum status, which includes all the same perks of Gold status plus early check-in, car rental upgrades with Avis and Budget, and Caesars Rewards status match. Cardholders receive 7,500 bonus points each anniversary year with no spending requirement.

Annual fee: $75.

Analysis: If you routinely stay at Wyndham hotel brands such as Wyndham, Hawthorn Suites, Days Inn and La Quinta, the Wyndham Rewards Earner® Plus Card may be a valuable addition to your stays. The automatic Platinum status grants you additional perks such as early check-in, car rental upgrades and a 10% discount when redeeming points for free nights.

The sign-up bonus is worth $495, per TPG’s most recent valuations, and the automatic 7,500-point bonus each anniversary year helps offset the annual fee. Even if you spend only a few nights a year at Wyndham hotels, the higher elite status, improved earning rates on everyday purchases and superior welcome offer make the Wyndham Rewards Earner® Plus Card worthy of consideration.

Official application link: Wyndham Rewards Earner® Plus Card

Wyndham Rewards Earner® Business Card

Sign-up bonus: Earn 45,000 bonus points after spending $2,000 on purchases in the first 90 days.

Earning rates: Earn 8 points per dollar on purchases at Hotels by Wyndham and qualifying gas purchases; 5 points per dollar on marketing, advertising and utilities; and 1 point per dollar on all other purchases.

Benefits: Wyndham Rewards Diamond status, which includes all the perks of Platinum plus suite upgrades, a welcome amenity at check-in and the ability to gift Gold status to a family member or friend. Cardholders receive 15,000 points each anniversary year with no spending requirement. Cellphone insurance when using the card to pay your wireless bill ($50 deductible, $600 in coverage per event).

Annual fee: $95.

Analysis: Like the Wyndham Rewards Earner® Plus Card, the business version is a great card for travelers that stay at hotels by Wyndham a few times a year or intend to. Where this card outshines its fellow Wyndham cobranded cards is with two unique features.

Small-business owners can earn 5 points per dollar on utilities, with a broad definition of what constitutes utility purchases. Qualifying utility purchases are defined as telecommunications services, cable, satellite, electric, gas, heating oil and water, as identified by the merchant category code. A bonus category designed specifically for your bills at home, such as electricity and water, is virtually unheard of.

The second distinction that comes with the Earner® Business Card compared to the personal cards is cellphone insurance. While this benefit isn’t brand-new and is offered by other credit cards, this useful perk can save you up to $600 if you break your phone or if it’s stolen. If you’re a small-business owner and want to dive into Wyndham Rewards, this business card is hard to pass up.

The sign-up bonus is worth $495 according to TPG valuations.

The information for the Wyndham Rewards Earner® Business card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

How to use Wyndham Rewards points

The Wyndham Rewards loyalty program delivers a multitude of ways to earn and redeem your hard-earned points. You can use your Wyndham Rewards points for airline tickets or gift cards, or convert them into miles with airline partners. By far, though, redeeming Wyndham points for hotel reservations at more than 9,000 hotels worldwide provides the most value. For this guide, we’ll focus wholly on hotel stays as the best use of Wyndham Rewards points.

Related: The ultimate guide to earning and redeeming with Wyndham Rewards

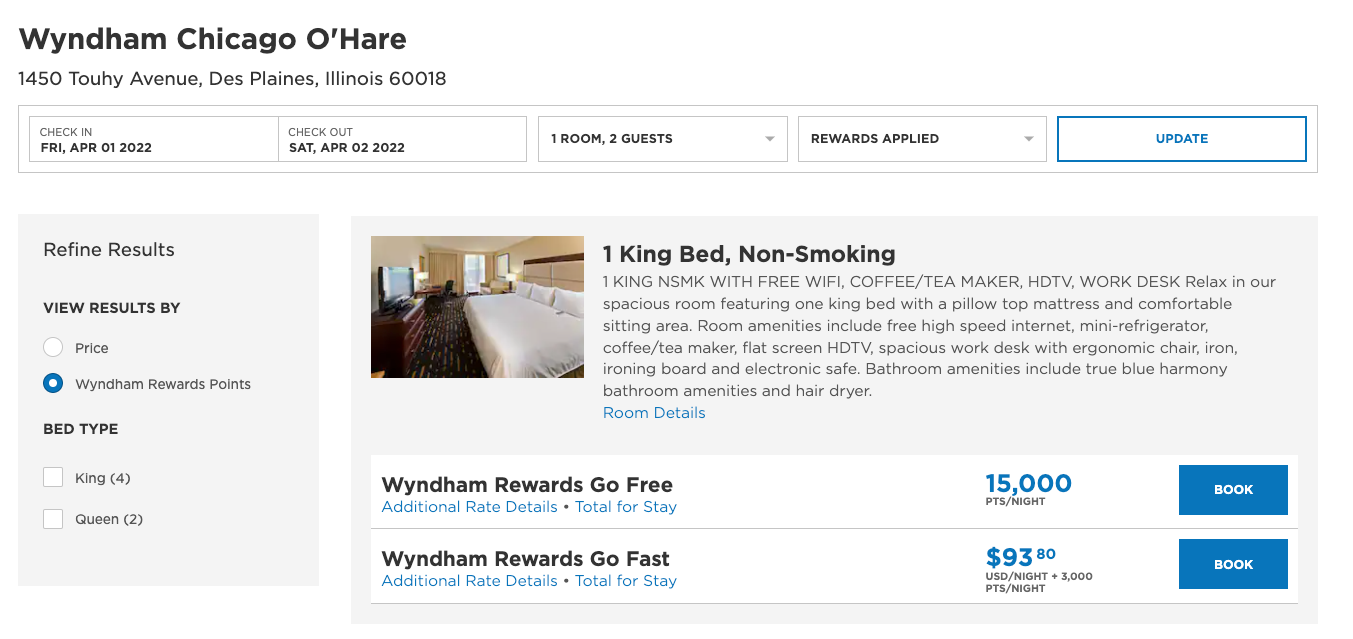

Wyndham Rewards properties are divided into three simple free night tiers — 7,500, 15,000 and 30,000 points per night. You can also book award nights for Wyndham Timeshare properties. Keep in mind, Wyndham prices its timeshares per bedroom per night. Therefore, a one-bedroom unit will cost you 15,000 points per night. A two-bedroom unit would cost 30,000 points per night.

You can also use a combination of cash and points to redeem for free nights. For example, if you’re eyeing a property that costs 15,000 points per night but don’t have enough points in your Wyndham Rewards account, you can use 3,000 points plus a reduced cash amount to book your free night stay. If you’re short on points, you can also transfer your Capital One miles or Citi ThankYou points to Wyndham Rewards at a 1:1 ratio. This can be a practical option for booking more expensive Wyndham hotels.

Wyndham’s points-plus-cash awards are called go fast℠ awards and cost 1,500, 3,000 or 6,000 points plus a cash copay. The amount of cash you pay will vary by the property you choose and is determined by a percentage of the room rate. On top of reasonable nightly award rates, all cardholders, regardless of which Wyndham card they have, will receive a 10% discount when redeeming points for hotel stays.

Practically, that means you can book a standard free night award starting at just 6,750 points. Wyndham Rewards points offer a bit of flexibility with their redemption options, though hotel stays, in general, will deliver the best value.

Related: 14 best Wyndham properties to book with points

Which card comes out on top?

The no-annual-fee Wyndham Rewards Earner® Card is worth a look if you’re averse to annual fees and are a novice to hotel rewards. The entry-level card features a welcome offer of up to 30,000 bonus points that can cover up to four free nights at one of Wyndham’s many brands, with rates starting at 7,500 points per night. That’s noteworthy value for a starter card.

Still, if you’re looking for a more rewarding Wyndham personal card, the Wyndham Rewards Earner® Plus Card is equipped with better earning rates, higher elite status (and thus more benefits) and 7,500 anniversary bonus points in exchange for a reasonable $75 annual fee.

While the two personal Wyndham Rewards cards are strong choices, the card with the most to offer just might be the business version.

The Wyndham Rewards Earner® Business Card dishes out an elevated earning structure with 8 points per dollar on gas purchases and a unique utilities bonus category that accrues 5 points per dollar on common office or household expenses such as electricity and water bills. Add top-tier Diamond elite status, 15,000 anniversary bonus points with no spending requirement and a 10% discount on award redemptions, and the business version packs a serious punch for a hotel cobranded card.

Bottom line

If you’re a frequent guest at hotel brands by Wyndham, these three credit cards merit your consideration. The current sign-up bonuses offer solid value, as you can earn up to 45,000 bonus points with the Wyndham Rewards Earner® or the Wyndham Rewards Earner® Business cards.

Whether you opt for the personal or business version, all cards achieve a valuable sign-up bonus which can be used for multiple free night rewards at Wyndham properties including Wyndham, LaQuinta, Ramada, Days Inn and more.

In addition to garnering enough points for free night rewards solely with the welcome bonus offer, every variation of the Wyndham cards includes a higher points-earning structure, complimentary elite status, no foreign transaction fees and a 10% discount when redeeming points for free nights.

That said, if you rarely visit Wyndham properties and don’t plan to, consider alternative travel cards like the Chase Sapphire Preferred Card or Capital One Venture Rewards Credit Card.

Official application link: Wyndham Rewards Earner® Card

Official application link: Wyndham Rewards Earner® Plus Card

Additional reporting by Emily Thompson and Stella Shon.