Editor’s note: TPG founder Brian Kelly is a Bilt advisor and investor.

American Express Membership Rewards and Chase Ultimate Rewards were the crème de la crème credit card points for years. With their extensive list of transfer partners, we’ve valued Amex and Chase points at 2 cents each — though there are many ways to get far more value for booking luxurious flights and hotel stays.

However, the points and miles landscape has recently become increasingly competitive. Almost every credit card issuer has introduced a rewards program to incentivize spending within its ecosystem.

One of these newcomers is Bilt Rewards — and it’s built (yes, pun intended) like none other. You can earn points for paying rent, which is great news since renting can amount to thousands of dollars spent annually. Despite being a new player in this competitive field, Bilt Rewards has an impressive lineup of transfer partners, including American Airlines AAdvantage and World of Hyatt.

We value Bilt points at 1.8 cents each though there are plenty of ways to get more value from them. Today, we’ll delve into all the details of the Bilt Rewards loyalty program, exploring how to earn and redeem points for maximum value.

How to earn Bilt Rewards points

Here’s the first thing you need to know: You don’t need the Bilt Mastercard® or pay rent to earn Bilt points. There are seven primary ways to earn Bilt points.

Rent

You can earn 250 points per on-time rent payment at Bilt Alliance properties through ACH or non-Bilt cards. That means you can earn up to 3,000 points per year, which we value at $54.

Alternatively, you can earn 1 point per dollar spent on rent at any home (up to 100,000 points per year) by paying your rent on the Bilt Mastercard. You can pay your rent via online with your Bilt Mastercard through the Bilt app. If your landlord only accepts physical checks, don’t fret: You can still pay your rent with the Bilt Mastercard on the app, then Bilt will directly mail your landlord a rent check each month, allowing you to earn points on rent without incurring any additional fees.

Bilt Mastercard

Speaking of the Bilt Mastercard, it offers a simple earning structure:

- 3 points per dollar on dining.

- 2 points per dollar on travel.

- 1 point per dollar spent on rent payments (up to 100,000 points per year).

- 1 point per dollar on all other purchases.

You must use your card at least five times during each statement period to earn points.

There’s a whole suite of impressive perks for this no-annual-fee card, including complimentary cellphone protection, trip cancellation and interruption protection, no foreign transaction fees and more. You do not need to pay rent to apply for the Bilt Mastercard.

Related: Should you use the Bilt Mastercard? Why it could be a game changer for renters

Bilt Dining

Bilt also has its own dining rewards program, Bilt Dining. Currently, the program operates in Atlanta, Boston, Chicago, Dallas and New York City, though there are plans to add more cities.

You can link any Visa, Mastercard or American Express credit card to the Bilt Dining program to earn 5 points per dollar at Bilt Dining restaurants when you pay with any eligible card in your Bilt Wallet.

These earnings are in addition to what you earn with your credit card. For example, if you pay with your Bilt Mastercard, you’ll earn 3 additional points per dollar spent, making for a total of 8 Bilt points per dollar spent. Put differently, that’s a 14.4% return on your dining purchases.

Bilt Travel Portal

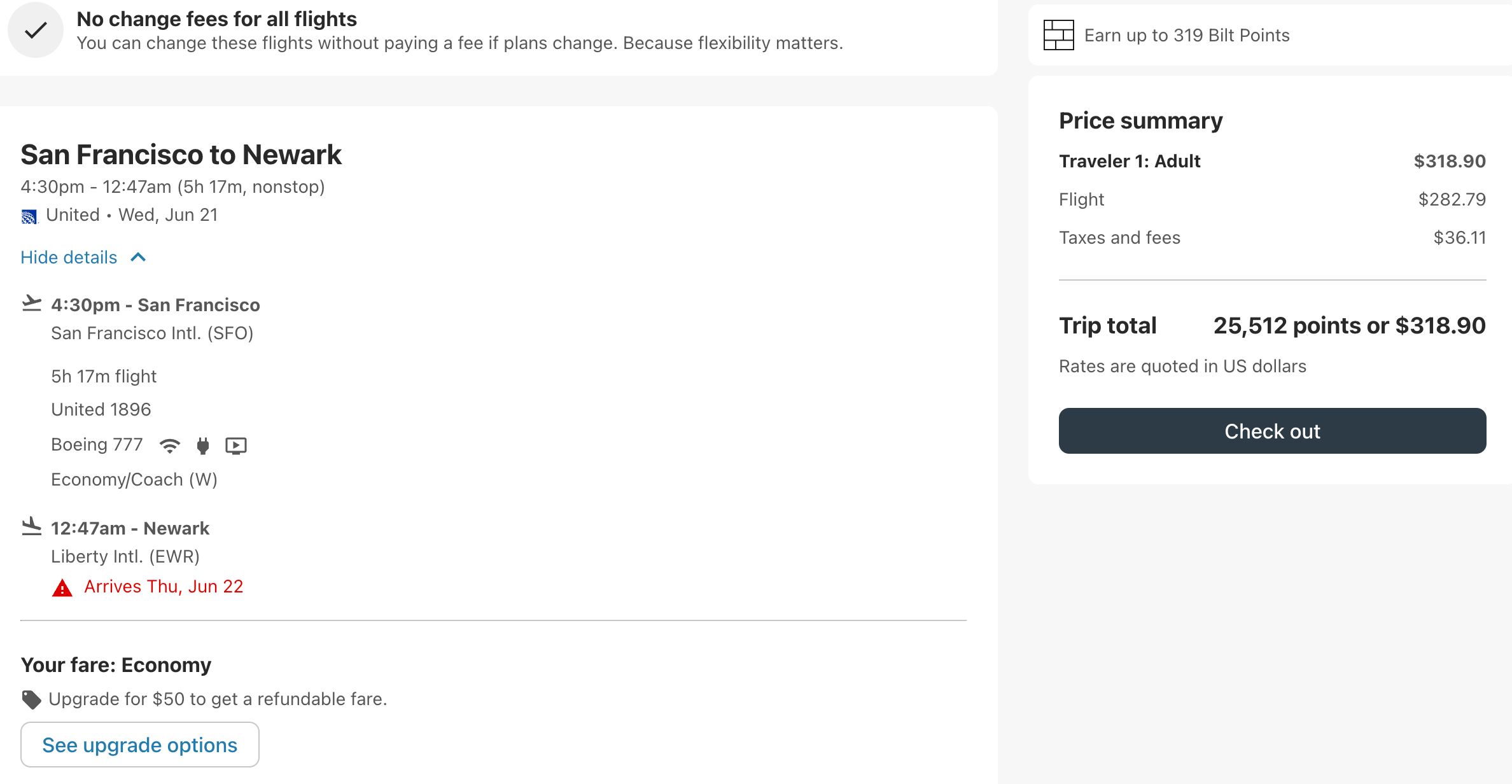

Expedia powers Bilt’s travel portal, so you can earn points on flights, stays, car rentals and things to do. As a Bilt member, you earn 1 point per dollar on travel booked through the travel portal.

For example, by booking this one-way United ticket from San Francisco International Airport (SFO) to Newark Liberty International Airport (EWR), you’d earn 319 Bilt points.

As a Bilt Mastercard holder, you earn 2 points per dollar on travel booked through the portal and 2 points per dollar by charging your purchase to the card, for a total of 4 Bilt points per dollar spent.

Referrals

You’ll earn 2,500 points each time you refer a friend to the Bilt Mastercard. For every five referrals, you earn 10,000 bonus points, up to 2,000,000 points. You can refer friends to the card through the website or app.

Lyft

You can earn 2 Bilt points per dollar on Lyft rides when you link your accounts. When you pay for your ride on the Bilt Mastercard, you’ll also receive an additional 3 Bilt points per dollar spent. For most, Bilt Rewards is the best Lyft reward partner.

SoulCycle

You can earn up to 10 points per dollar on SoulCycle classes booked through Bilt.

Elite status through Bilt Rewards

Bilt offers four status tiers. Here’s a quick overview:

| Blue | Silver | Gold | Platinum | |

| Qualification (points earned per year) | All Bilt Rewards members. | 25,000 points. | 50,000 points. | 100,000 points. |

| Earn interest on your points (at the FDIC-published national savings rate) | ✓ | ✓ | ✓ | |

| Access to complimentary home ownership concierge | ✓ | ✓ | ||

| Bonus points on new leases or lease renewals | 10%. | 25%. | 50%. | |

| Complimentary Bilt collection gift | ✓ |

Your member status is based on the total points earned in a calendar year. Elite status earned between Jan. 1 and June 30 each year will expire on Jan. 31 of the following year. Meanwhile, status earned between July 1 and Dec. 31 will remain active for the rest of the year it was earned and the entire following year.

Related: Quick Points: How to earn ‘interest’ on your rewards balance with Bilt

Redeeming Bilt Rewards points: Poor-value options

The Bilt Rewards loyalty program gives you many ways to use your points, though not all carry equal value.

If you want to extract the maximum value from your Bilt Rewards points, you’ll likely want to avoid some of these less valuable redemption options:

Use points for Amazon purchases

You can select your Bilt Mastercard on Amazon.com as a payment method and redeem your points to cover all or a portion of your purchase at checkout. However, Bilt points are worth 0.7 cents each when used this way. For example, you’ll need approximately 14,300 Bilt points to cover a $100 Amazon purchase. Compare that to the potential estimated value of 1.8 cents apiece (or greater) and it’s not necessarily the best value.

Shop the Bilt Collection

The Bilt Collection is a curated list of items, including art, home decor and apparel. The value per point will vary but rarely exceed more than 1 cent per point, so you should likely pass on this option.

Redeem your points for fitness classes

Fitness enthusiasts can redeem their Bilt points to attend name-brand classes like SoulCycle, Solid Core, Y7 Studio and Rumble Boxing. The value will depend on the class you select but hovers around just 1 cent per point.

Pay your rent with points

A potentially enticing option with your points is to save them to help cover your next rent payment. However, this is only available if you live in a Bilt Rewards Alliance property or opt for check payments. And even worse, the redemption value is just 0.55 cents per point.

Related: 5 common purchases you should never redeem miles for

Redeeming your Bilt Rewards points: Medium-value options

The following redemption options will get you a decent value with a redemption rate of at least 1 cent apiece:

Use your points to save up for a down payment on a home

Bilt offers the unique ability for users to save up their points toward a down payment on a home one day. If you opt for this route, your Bilt points are valued at 1.5 cents each toward a down payment.

Redeem for travel on the Bilt Travel portal

You can use the Bilt Travel Portal to offset the cost of flights, stays, rental cars or activities — at a rate of 1.25 cents per point.

Transferring to airline and hotel partners: Best value

Nothing beats the outsize value of transferring your points to Bilt’s airline and hotel partners. Bilt has 14 airline and hotel transfer partners. Bilt Rewards is the only transferable points program to offer American Airlines AAdvantage as a transfer partner, which is one of our favorite options for some pretty amazing sweet spots.

It’s free to join these loyalty programs, even if you’ve never flown or stayed with any. Plus, Bilt gives cardholders 100 bonus points for each loyalty program you link to your account. This is a no-brainer and can easily get you 1,400 bonus points with minimal effort.

You can easily get 1.8 cents per point in value — or perhaps much more — and score a lie-flat airplane seat or a luxurious hotel stay by transferring your Bilt points to the right programs, all at a simple, 1:1 transfer ratio:

| Program | Ratio | Transfer time |

| Aer Lingus AerClub | 1:1. | Within minutes. |

| Air Canada Aeroplan | 1:1. | Within 24 hours. |

| Air France-KLM Flying Blue | 1:1. | Within minutes. |

| American Airlines AAdvantage | 1:1. | Within minutes. |

| British Airways Executive Club | 1:1. | Within minutes. |

| Cathay Pacific Asia Miles | 1:1. | Within minutes. |

| Emirates Skywards | 1:1. | Within minutes. |

| Hawaiian Airlines HawaiianMiles | 1:1. | Within minutes. |

| Iberia Plus | 1:1. | Within minutes. |

| IHG One Rewards | 1:1. | Within minutes. |

| Turkish Airlines Miles&Smiles | 1:1. | Within minutes. |

| United Airlines MileagePlus | 1:1. | Within minutes. |

| Virgin Atlantic Flying Club | 1:1. | Within minutes. |

| World of Hyatt | 1:1. | Within minutes. |

There are some particularly high-value loyalty programs that you can leverage for maximum value. Here are a few ideas to get you going:

- Through American Airlines AAdvantage, you can book the famous Qatar Airways Qsuite, a long-haul business class product, between the U.S. and Doha one-way for just 70,000 points.

- Book a round-trip United economy ticket to Hawaii for just 15,000 miles through Turkish Airlines Miles&Smiles.

- Using Iberia Plus, book a one-way business-class flight from the East Coast to Adolfo Suárez Madrid-Barajas Airport (MAD) for as little as 34,000 points.

- Transfer 47,500 points to Virgin Atlantic Flying Club to book ANA business class one-way from the East Coast to Japan.

- Transfer your points to World of Hyatt and score a stay at the ultra-luxurious Park Hyatt St. Kitts Christophe Harbour for 25,000-35,000 points per night or at an all-inclusive resort in the Caribbean (like the Hyatt Zilara Rose Hall in Jamaica).

Bilt Rewards has historically offered some of the best transfer bonuses we’ve seen during Rent Day (the first of every month). This includes a 100% transfer bonus to Air France-KLM Flying Blue and HawaiianMiles.

Simply put, the options are endless. And because so many of Bilt’s transfer partners overlap with existing transferable points programs, you can refer to our guides as inspiration to maximize programs like Air Canada Aeroplan, Air France-KLM Flying Blue, Virgin Atlantic Flying Club and so many more.

Related: 7 of the best airline award chart sweet spots

Bottom line

Bilt Rewards presents an exceptional value proposition for both renters and non-renters. Bilt has established partnerships with some of the more lucrative airline and hotel loyalty programs, enabling you to extract extraordinary value from your points. Your points transfer seamlessly at a straightforward 1:1 ratio and most programs process the transfers instantly.

Even if you aren’t renting or don’t want to apply for the Bilt Mastercard, you can earn lots of points by linking your Lyft account, enrolling in Bilt Dining and booking travel through the Bilt Travel Portal.

Additional reporting by Juan Ruiz.

See Bilt Mastercard rates and fees here.

See Bilt Mastercard rewards and benefits here.